Sterling weakens against the euro and the dollar amid UK political turmoil and the BoE's dovish stance. The euro holds its ground despite the ECB's caution. The dollar drifts ahead of key data, while yen and yuan moves reflect policy and fiscal expectations.

GBP: Sterling Under Pressure as Political Chaos Mounts

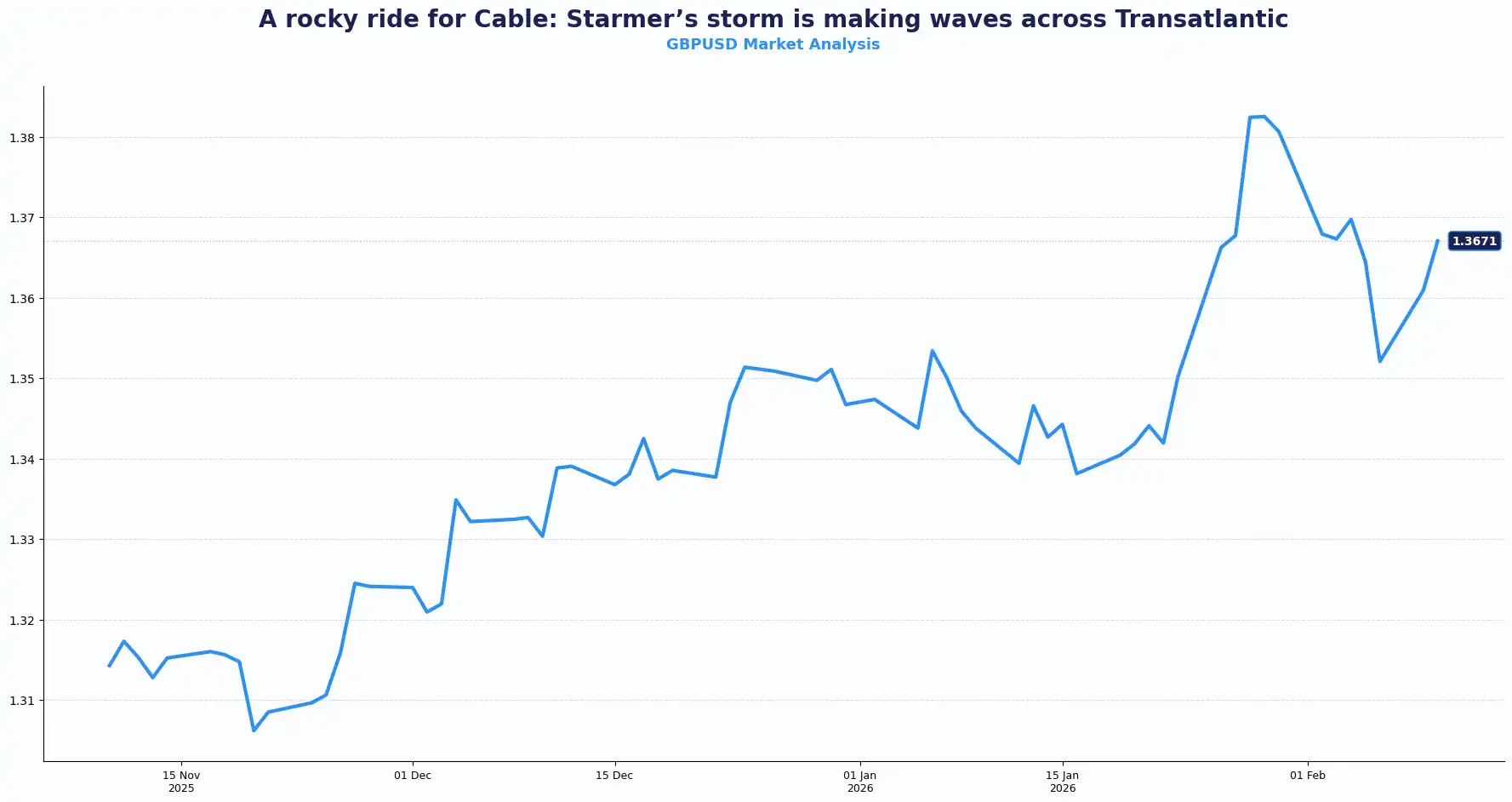

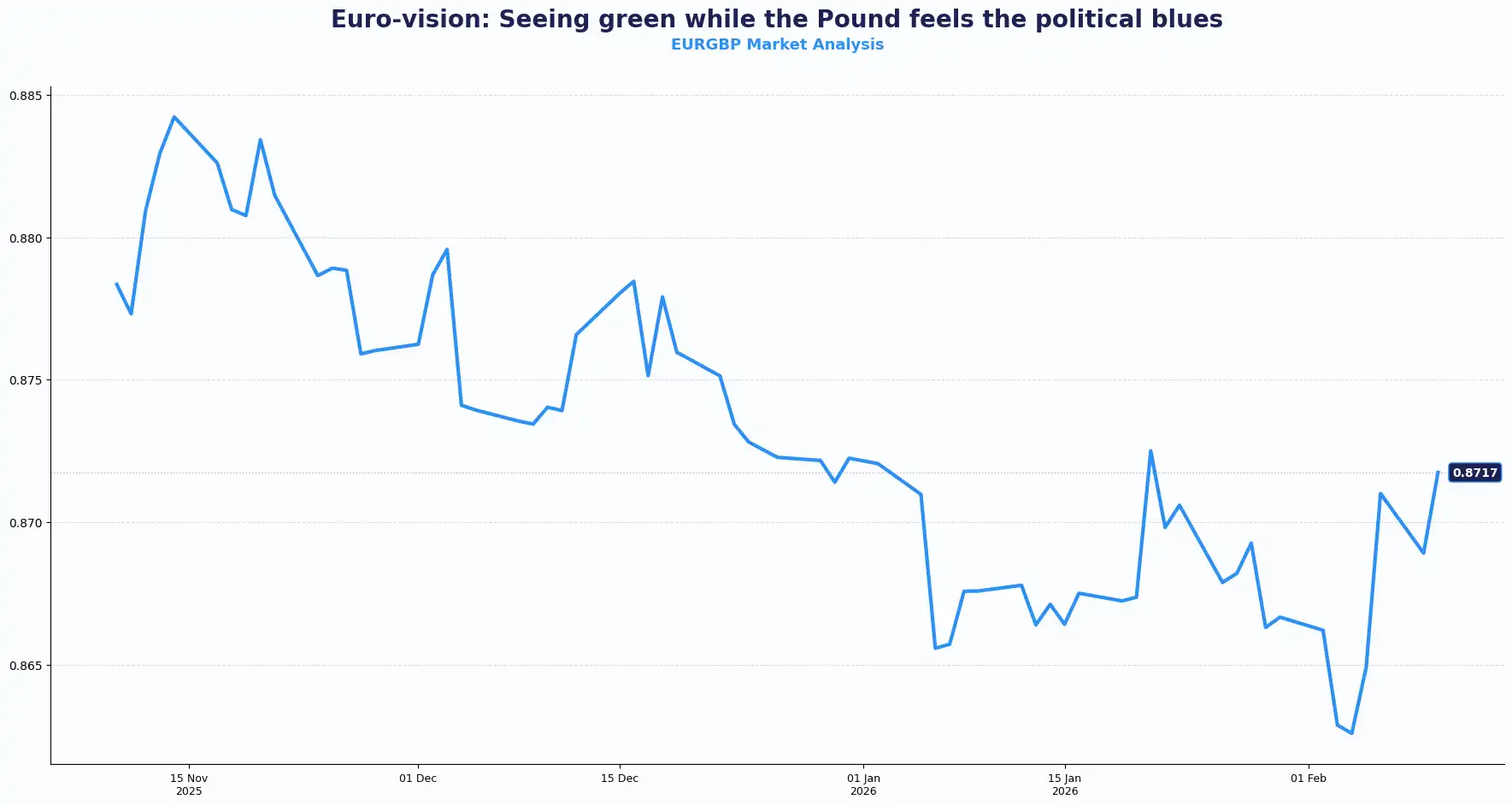

Sterling extends losses. GBP/USD trades near 1.3670 while EUR/GBP rose to 0.8715. Political instability surrounding Prime Minister Starmer and renewed rate-cut expectations weigh on the currency. The resignation of the Prime Minister’s chief of staff and ongoing scrutiny over ambassadorial appointments intensify political risk ahead of local elections.

Political instability traditionally unsettles currency markets. British government bonds (gilts) underperformed their European peers on Monday as traders focused on Starmer's situation. Concerns grow that a leadership shift could trigger increased government spending and a move toward left-leaning fiscal policies. The potential release of private communications regarding the Mandelson appointment adds further reputational risk.

Sterling and gilts continue to be under pressure as investors weigh the prospect of personnel changes at numbers 10 and 11 Downing Street.

The Bank of England’s (BoE) latest meeting added a dovish tilt. Weak consumption, subdued investment and soft productivity continue to restrain growth. BoE Catherine Mann commented that budget energy-price measures may trim inflation by roughly 50 bps by mid-year, reinforcing expectations of policy easing.

Political uncertainty in Westminster typically correlates with sterling weakness and gilt volatility. Participants often review currency exposure when domestic political risks threaten to shift fiscal trajectories.

The pound looks set to continue trending weaker across the board. GBP/JPY trading near 212.12 reflects this weakness, whilst the European Central Bank (ECB) seems likely to keep rates steady for the foreseeable future. Expectations of lower relative returns dent the pound’s appeal versus the euro.

EUR: Euro Holds Ground as ECB Downplays Rally

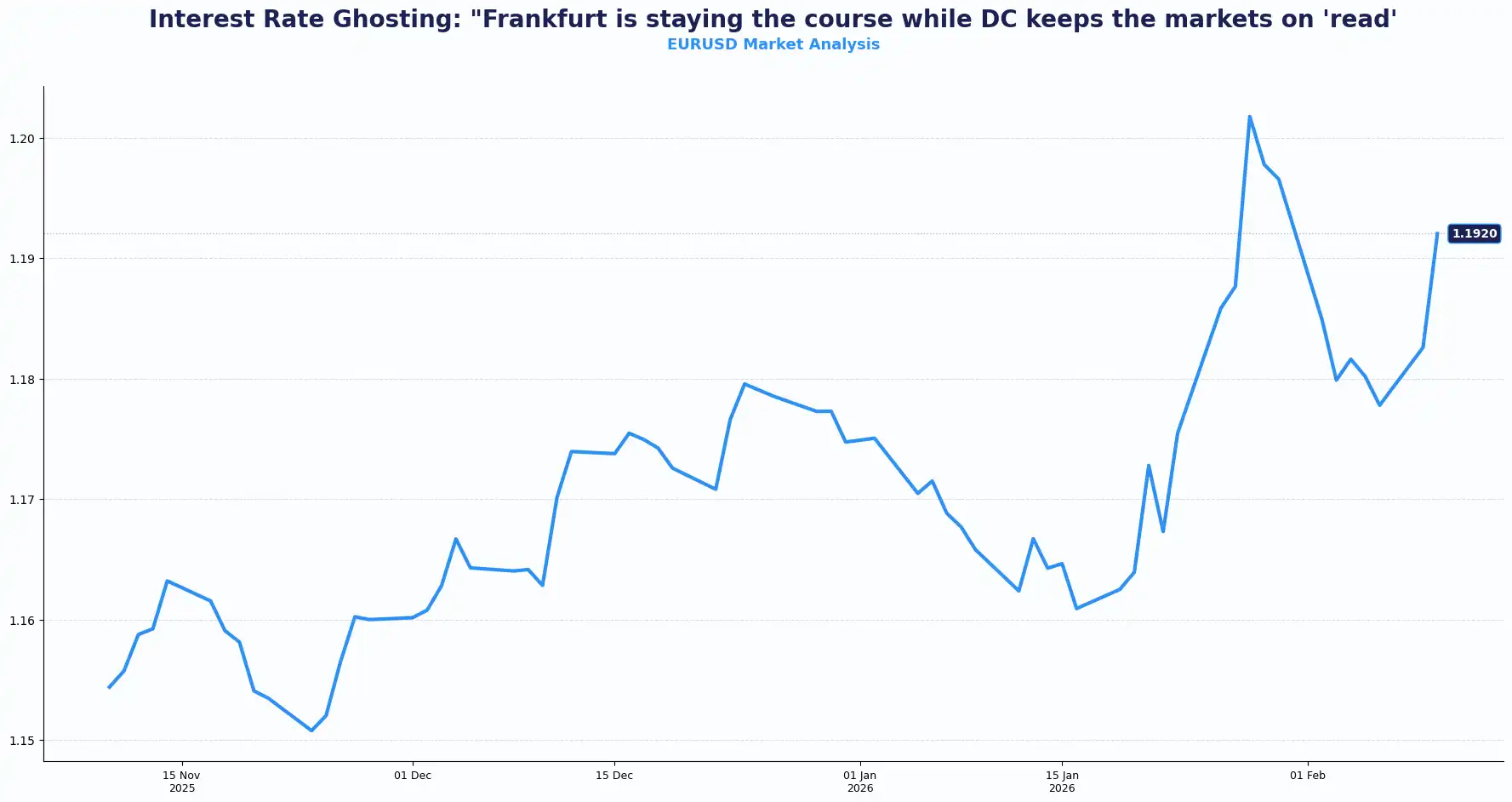

The EUR/USD pair lost ground to around 1.1905, snapping a two-day winning streak yet hovering near its strongest level since late January. This resilience follows signals from the ECB regarding the euro's recent appreciation.

ECB President Christine Lagarde signalled that the euro area's inflation outlook is broadly on track, downplaying the impact of the recent euro rally. She suggested that upcoming data may prove volatile and should not drive policy decisions in isolation.

BoE MPC member Catherine Mann flagged that Chinese trade diversions are likely to affect Europe more than the UK, potentially dragging on Eurozone GDP. US importers are lowering prices to maintain competitiveness while offsetting revenue pressures by raising prices on imports to the UK and the Eurozone.

Despite these headwinds, the euro maintains a stronger relative position than sterling. Divergent central bank rhetoric between the ECB and the BoE influences the EUR/GBP cross. Stability in Frankfurt, contrasted with dovishness in London, has influenced recent shifts in capital flows

USD: Dollar Drifts Lower Ahead of US Data

Dollar Index (DXY) traded at 96.79, hovering near a one-week low. The US dollar weakened on Tuesday ahead of a slate of economic data expected to shape the Federal Reserve's (Fed) interest rate path. Delayed labour and CPI reports now carry heavier signalling weight for Fed expectations.

White House advisor Kevin Hassett suggested US job gains could slow due to higher productivity and a cooling labour force. The dollar continues to face pressure amid forecasts of a below-consensus payrolls report. Wednesday’s non-farm payrolls are expected to show a modest increase of 70,000 jobs. Investors are now assessing whether the labour market weakness has tapered off.

Dollar pressure is expected to persist. Traders continue to price in two Fed rate cuts this year, with the first anticipated in June. The nomination of Kevin Warsh to succeed Jerome Powell introduces fresh uncertainty to the policy outlook. This transition period has led some market participants to adjust their long-term outlooks for the dollar.

Weakening labour market data and leadership changes at the Fed traditionally soften the dollar. Incoming labour-market data and leadership uncertainty shape near-term dollar direction, keeping volatility tied closely to macro releases.

Yen extends gains After Takaichi Victory

In other currencies, the yen strengthened for a second session following Prime Minister Takaichi's victory, with USD/JPY last at 155.24 after a 0.8% gain on Monday. Official rhetoric helped stabilise the currency after its initial post-election pullback. The decisive election outcome is seen as reducing policy uncertainty and supporting fiscal discipline.

The spotlight has shifted to Japan's $1.4 trillion in foreign reserves, a potential tool for future yen intervention. The currency has declined 6% since Takaichi assumed leadership of the Liberal Democratic Party (LDP) in October. Expectations for further fiscal easing under her administration point to renewed downside pressure on the yen, with USD/JPY poised to extend gains.

AUD/USD consolidates below 0.7100 on broad US dollar weakness. The Australian dollar has tracked broader dollar movements in recent sessions.

The Chinese yuan strengthened past 6.91 per dollar for the first time since May 2023 and is expected to rise throughout the year. Seasonal corporate conversion demands and the central bank's stronger guidance have lifted CNY confidence. News that China has urged local banks to diversify from US treasuries led to some dollar weakness.

Markets look ahead:

-

Wednesday, 11 Feb: US NonFarm Payrolls (key data)

-

Wednesday, 11 Feb: Unemployment Rate

-

Thursday, 12 Feb: US Initial Jobless Claims

-

Friday, 13 Feb: US CPI

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.