MARKET OUTLOOK (GBP, EUR & USD) JUNE 2025

GBP

The pound again gained ground in May, notching a fourth monthly advance against the dollar, and briefly trading north of the $1.35 mark, before pulling back a touch into month-end. Such a streak, though, does mark the quid’s best monthly run since late-2022.

This move, furthermore, in contrast to recent months, was more about organic GBP strength than any USD weakness. This is obvious if we were to look at GBP/EUR, where the pound notched its first monthly gain in three, with spot briefly touching its best levels since ʻLiberation Day’ in the process.

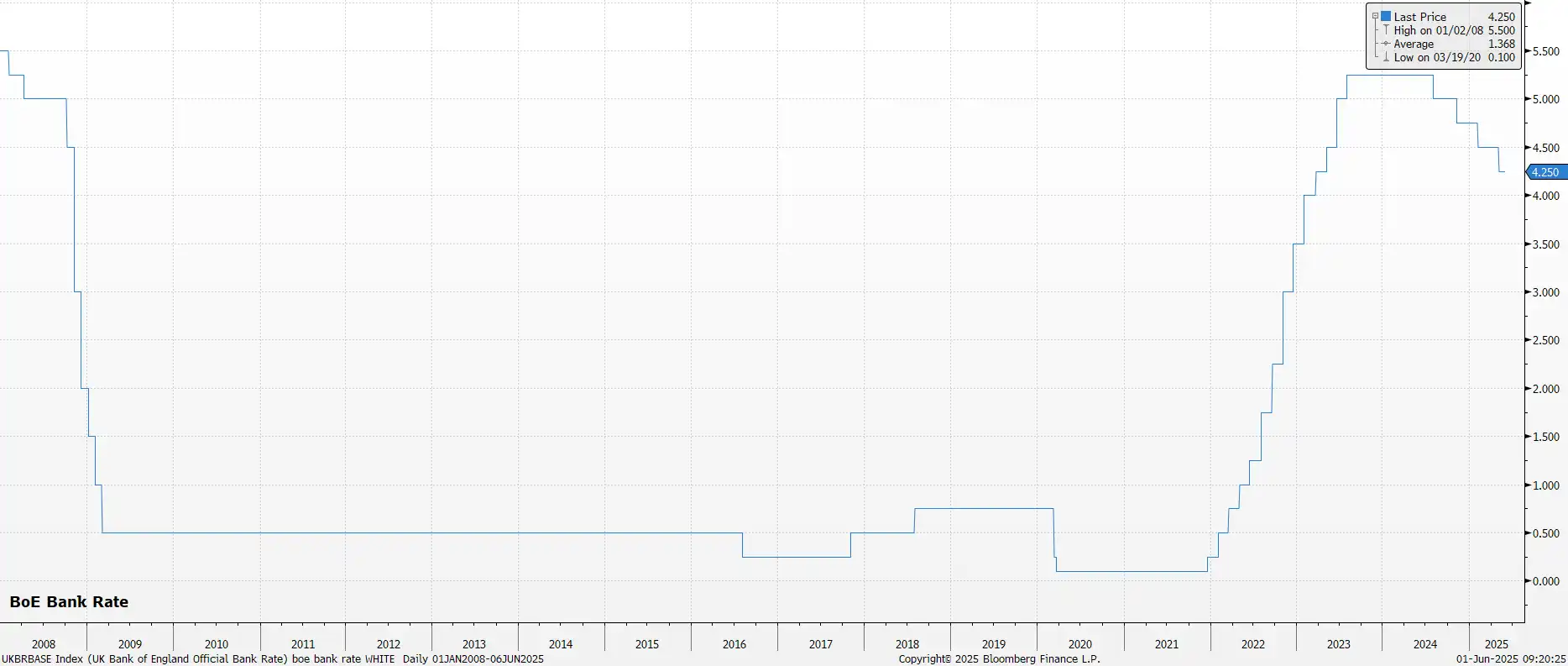

Perhaps the most significant catalyst for this GBP strength was a considerably more hawkish than expected May Bank of England policy decision. While the MPC did indeed deliver the 25bp cut that market participants had been expecting, lowering Bank Rate to 4.25%, two of the nine Committee members dissented, instead preferring to stand pat. This was not, though, the only hawkish surprise, with the policy statement reiterating that the MPC will take a ʻgradual and careful’ approach to future policy easing, and not making the dovish pivot that many had expected to see.

This was, however, somewhat perplexing, given that the Bank’s updated economic forecasts pointed to higher unemployment, lower inflation, and slower growth, than had been foreseen back in February. This, hence, raises the risk that the MPC will need to go further and faster on rate cuts towards the end of the year, especially with the bar for a June cut now very high indeed, and the next step back towards neutral not likely to come until the August confab.

A hotter-than-expected April inflation figure has also dented the chances of a more aggressive BoE, in the short-term at least. Headline CPI rose to 3.5% YoY, while the closely-watched services inflation metric rose to 5.4% YoY, both considerably above the Bank’s expectations. That said, numerous one-off factors skewed the data higher, most notably the usual round of index-linked price rises that take effect at the beginning of the fiscal year, with higher energy prices also introducing an upwards skew.

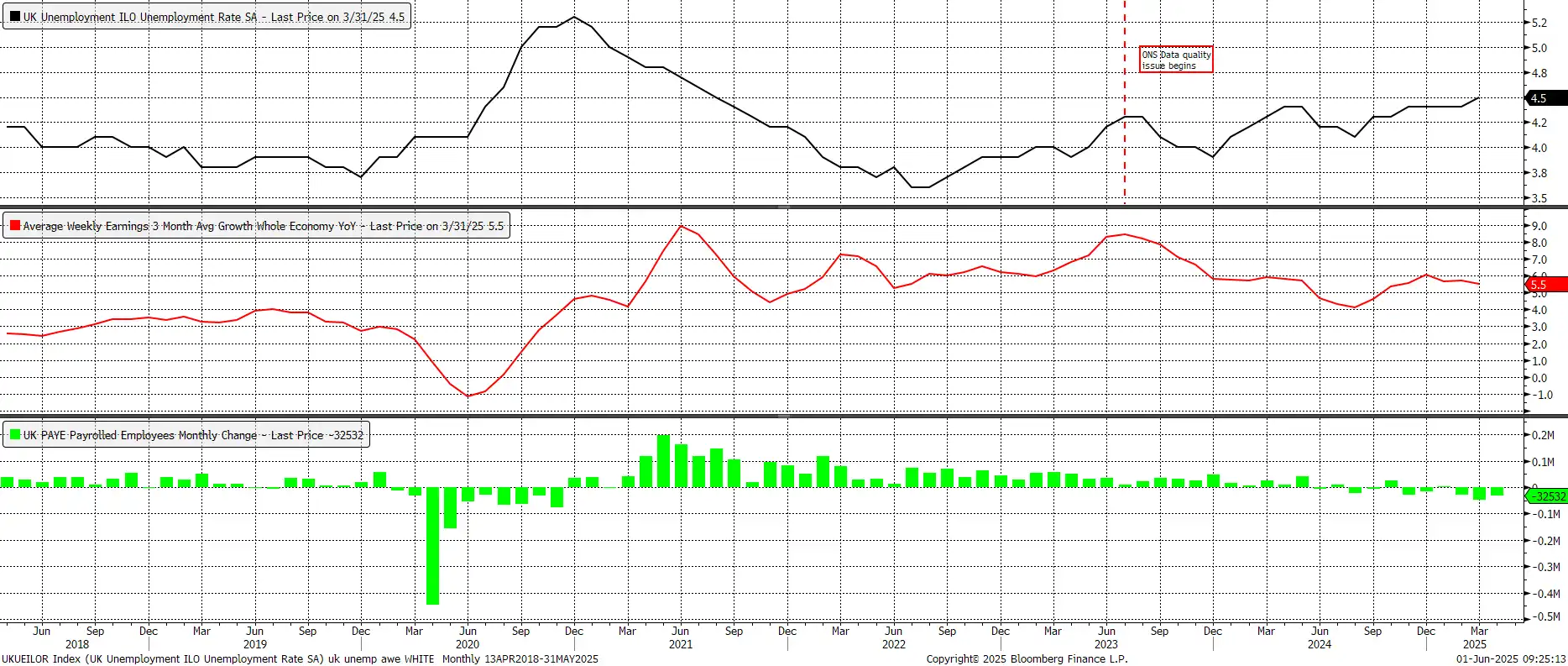

It is, frankly, difficult to see these price pressures becoming embedded within the economy, with the recent rise in inflation likely to be little more than a ʻhump’ over the summer months. One obvious reason for this is the continued weakness seen in the labour market, where unemployment now stands at its highest level since the summer of 2021, and where – per HMRC data – employment has fallen in five of the last six months. With such a dismal demand outlook, the ability for firms to pass higher prices onto consumers is very limited indeed.

Consequently, while the UK economy – and by extension, the pound – have surprised to the upside compared to expectations thus far this year, trouble could well be brewing, as the pace of labour market slackening quickens and, of course, as we brace for another round of tax hikes, and government spending cuts, in the autumn Budget.

EUR

The common currency extended its streak of gains into a fifth straight month in May, though this advance did somewhat fizzle out as time went on, with EUR/USD eventually settling into a tight range just shy of the $1.14 mark.

These gains in the EUR, in contrast to the move higher in the GBP, appear more linked to USD weakness than any eurozone-specific factors. Frankly, the bloc’s economy remains in something of a dismal state, with downside risks still significant, amid President Trump’s continuing global trade crusade.

This crusade continued in May, with Trump threatening the EU with a 50% tariff on goods exported to the US, ostensibly due to the slow progress being made in trade negotiations between the two sides. While this threat was reversed within 48 hours, it nevertheless provides further evidence of the flippant nature with which US trade policy is being made, presenting yet another growth headwind with which the eurozone economy must contend.

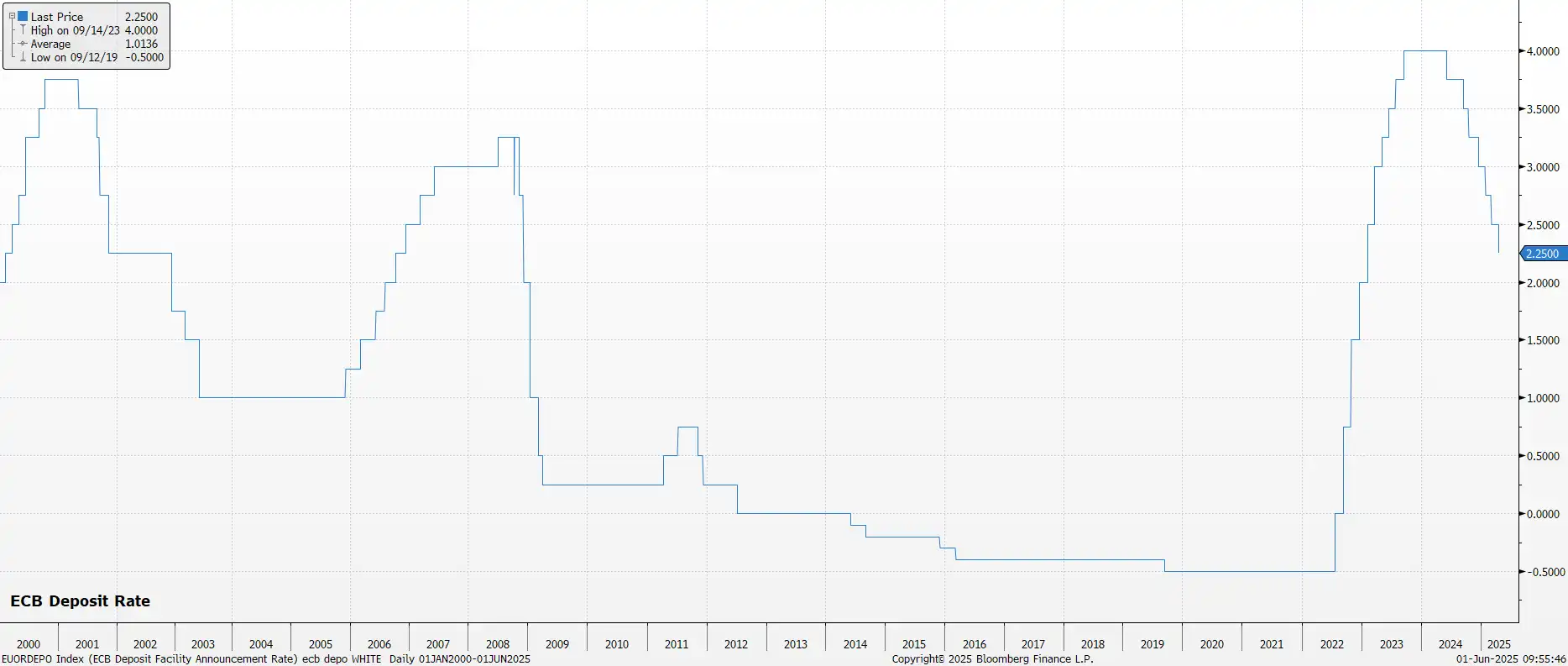

Against this backdrop, it is little surprise to see the ECB maintaining a dovish stance. While policymakers did not meet in May, the June meeting is almost certain to see another 25bp cut delivered, lowering the deposit rate to 2.00%, with further cuts likely to come in the months ahead, even as policymakers officially stress that they are following a ʻdata-dependent’ approach.

In fact, the likelihood of rates being reduced below 1.75%, the bottom end of the ECB’s neutral rate estimate range, continues to grow. This is not only a result of the aforementioned downside growth risks, but also as the eurozone inflationary outlook looks increasingly benign.

Headline CPI remained at 2.2% YoY in April, while the demand shock caused by aforementioned trade tensions means that any sustained increase in inflationary pressures seems a long shot at best. In fact, when coupled with the significant strengthening in the EUR seen since the turn of the year, disinflationary headwinds continue to mount, providing further justification to the ECB’s doves that increased policy easing remains necessary.

Naturally, ongoing geopolitical tensions also continue to weigh considerably on the bloc’s economy, especially as another month passes with scant progress having been made towards a resolution of the conflict in Ukraine. A sustainable truce, or peace agreement, is probably the most obvious potential catalyst for organic EUR strength at this juncture, particularly as any EU-US trade deal not only looks some way off, but is also likely to be constructed on very shaky foundations indeed.

USD

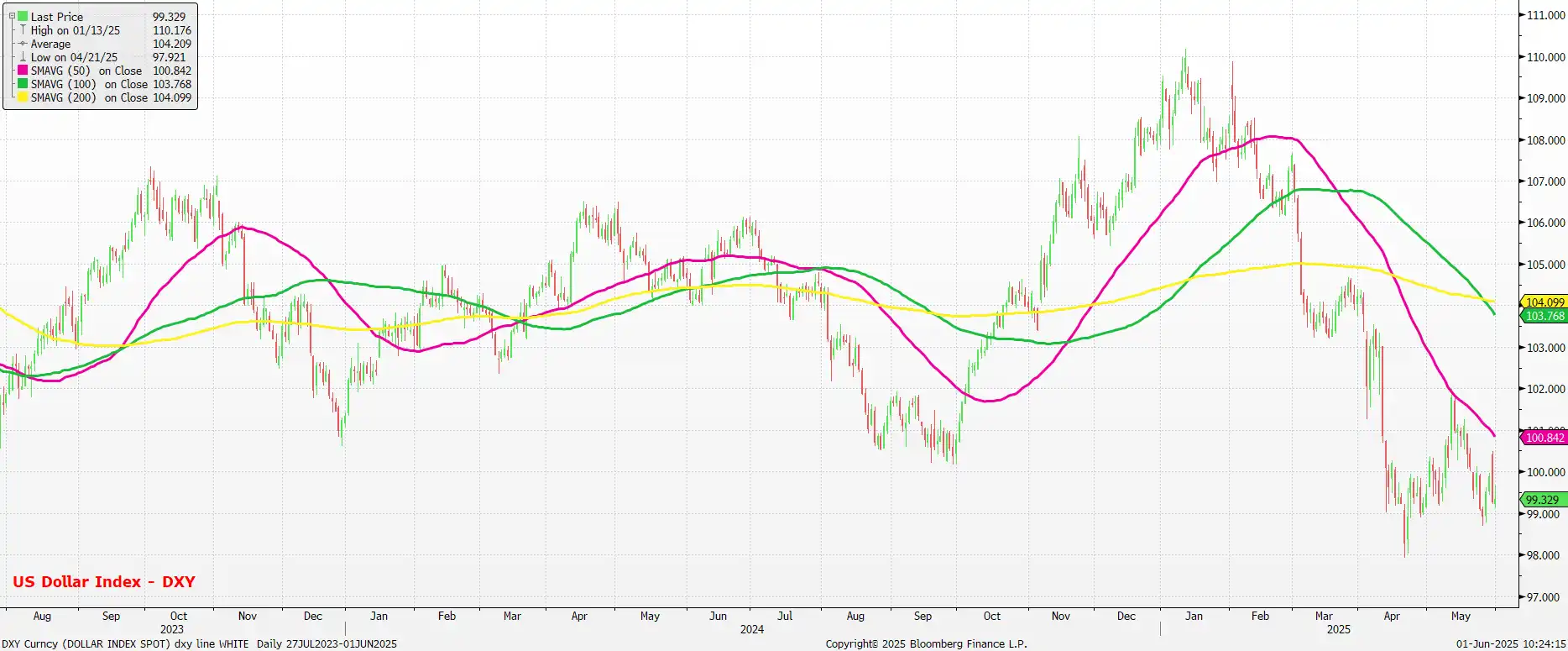

Perhaps unsurprisingly, given the notable strength seen elsewhere in G10 FX, the dollar lost ground in May, declining against a basket of peers – as measured by the DXY – for the fifth month in a row, though these declines were considerably more modest than the roughly 4% losses seen in both March and April.

Nevertheless, these losses came as international market participants continue to take a relatively dim view of US-based assets. This stems not only from the volatile and incoherent nature with which US trade policy continues to be made, but also as increasing attention is paid to an obscure clause in President Trump’s ʻone, big, beautiful bill’ which could result in punitive tax treatment for overseas investors that hold US assets.

Despite that, that bill continues to make its way through Congress, with the $4tln in tax cuts, and sizeable increase in the debt ceiling now passing through the Senate, and still on track to be ready for signing into law by Independence Day. Naturally, such fiscal largesse has sparked further concerns over the sustainability of the fiscal path of the US economy, which took 30-year Treasury yields north of 5% during the month.

Meanwhile, on the trade front, investors have coined a new moniker – TACO, standing for Trump Always Chickens Out. While this has gone down like a lead balloon in the Oval Office, the nickname is not without cause, given the frequent U-turns on tariffs that the President continues to make. Those U-turns, though, further contribute to the ʻsell America’ trade, which continues to pose headwinds to the greenback.

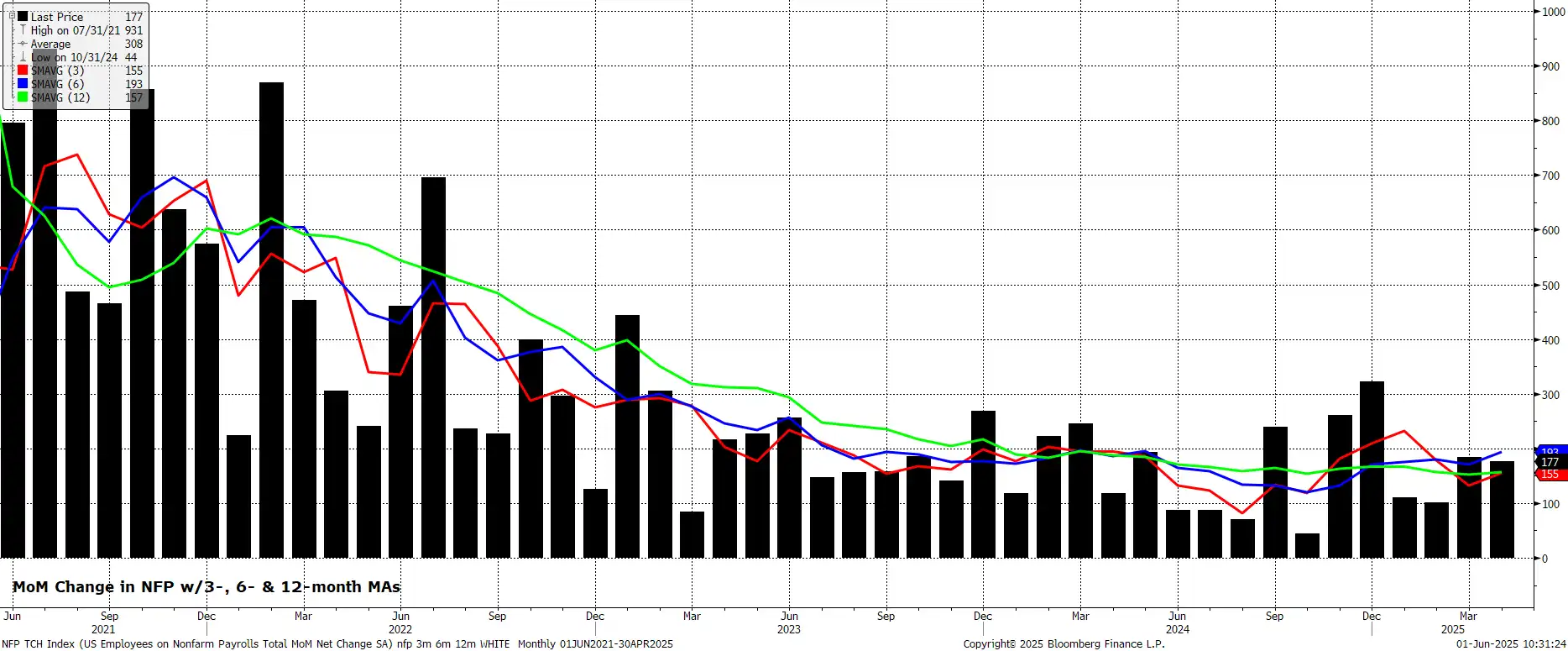

Amid all of this, however, the economy has remained remarkably resilient, with the labour market tight, underlying growth solid, and the disinflation process continuing in ʻimmaculate’ fashion. In fact, if businesses across the country weren’t paralysed by tariff-related uncertainty, one would easily be branding this as a ʻgoldilocks’ backdrop.

This uncertainty, though, should keep the FOMC on the sidelines, not only at the June policy meeting, but for the foreseeable future. Policymakers’ priority remains ensuring that inflation expectations remain well-anchored, and that any tariff-induced surge in prices does not portend a longer-lasting rise in inflationary pressures.

The June confab, however, will also see the FOMC release their latest round of economic projections, though the ʻshelf life’ of the forecasts is likely to be extremely limited, given the ever-changing nature of trade policy. With that in mind, though, policymakers are likely to downwardly revise their short-term growth expectations, while upwardly revising the inflation profile in the near-term, with the tariffs that have been imposed being much higher than had previously been expected. In turn, this is likely to see the median expectation nudged higher, to signal just one 25bp cut being delivered this year.

Ordinarily, one would expect this hawkish policy divergence to be a boon for the buck. Nowadays, however, a greater degree of coherence from the political side of things is likely required before the dollar would be able to notch significant gains.