UK

2025 proved to be another sub-par year for UK Plc, amid constant fiscal fears, anaemic economic growth, a weakening labour market, and stubbornly high inflation. While there are increasing signs that price pressures have likely now peaked, many of the issues that plagued the economy this year are set to persist into next, with further labour market slack set to emerge, and political backdrop remaining a perilous one.

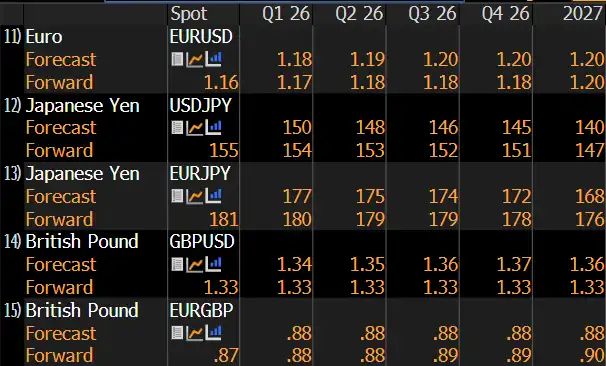

In spite of this, the pound has traded relatively well throughout the course of the year, with cable having advanced around 7% since the beginning of January, albeit trading some way off the YTD highs around 1.3750 that printed during the summer.

In truth, however, the vast majority of that move in GBP/USD has come by virtue of a broadly softer greenback. The GBP has, hence, traded in much softer fashion in the crosses, with GBP/EUR, for instance, having lost around 5% over the last 11 months.

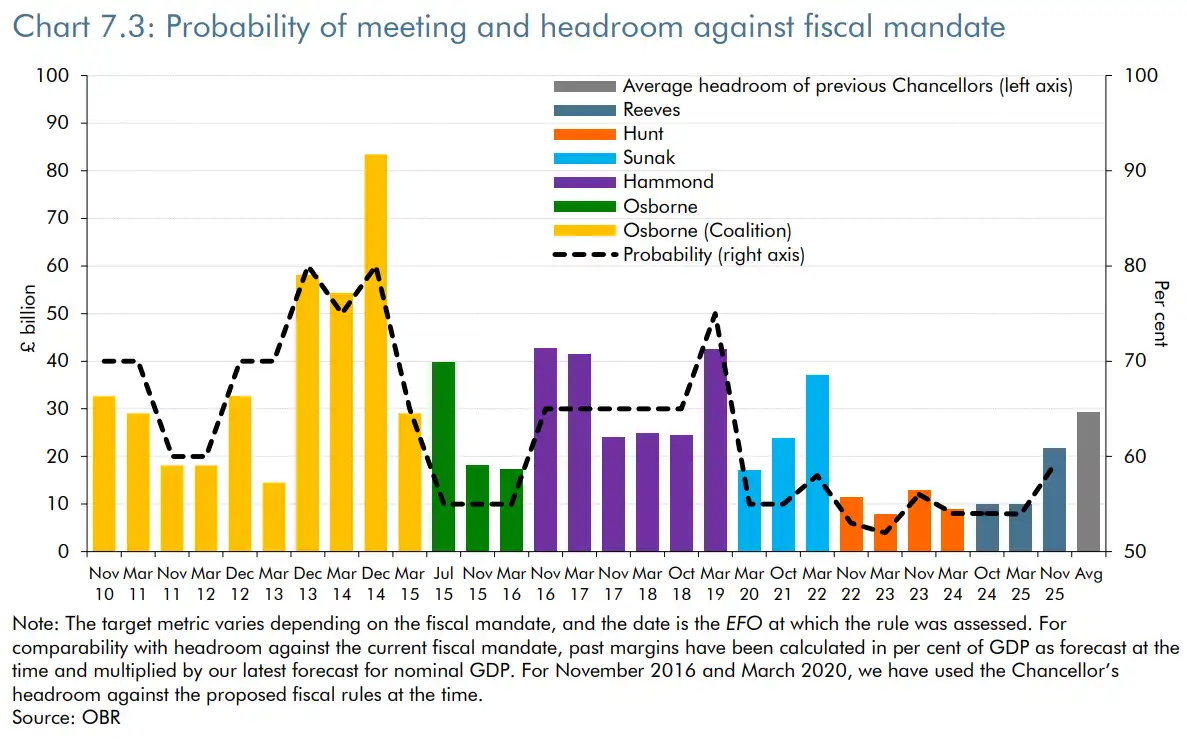

While the 26th November Budget has now been and gone, the policy measures announced by Chancellor Reeves are likely to do little to either materially improve the UK economic outlook, nor to materially reduce the risk of the 'doom loop' continuing for another year. The Budget was very much delivered with one audience in mind -- the Parliamentary Labour Party -- with the OBR noting that it contains a total of zero measures that significantly boost GDP growth expectations.

Consequently, the Budget was a 'classic' Labour one which can be summed up by the mantra of 'tax and spend'. However, while the approx. £10bln of spending increases are front-loaded, the tax hikes that are supposed to pay for this are back-loaded, not only to the end of the forecast horizon, but also to the year of the next general election. This means there remains a relatively high probability that a significant fiscal tightening will again be required in the 2026 Budget, for the third year running.

Political risks remain significant, and are in fact likely to grow throughout the next year. Next spring still seems like the most dangerous moment for the current administration to navigate, with local elections due to be held across England, as well as national polls in both Scotland and Wales.

Current polling points to Labour faring terribly in all of these polls. Consequently, it seems plausible to expect those elections to act as the 'straw that breaks the camel's back' among the PLP, with a post-election leadership challenge increasingly likely. Such a leadership contest would undoubtedly trigger higher volatility in UK assets, with risks tilted to the downside.

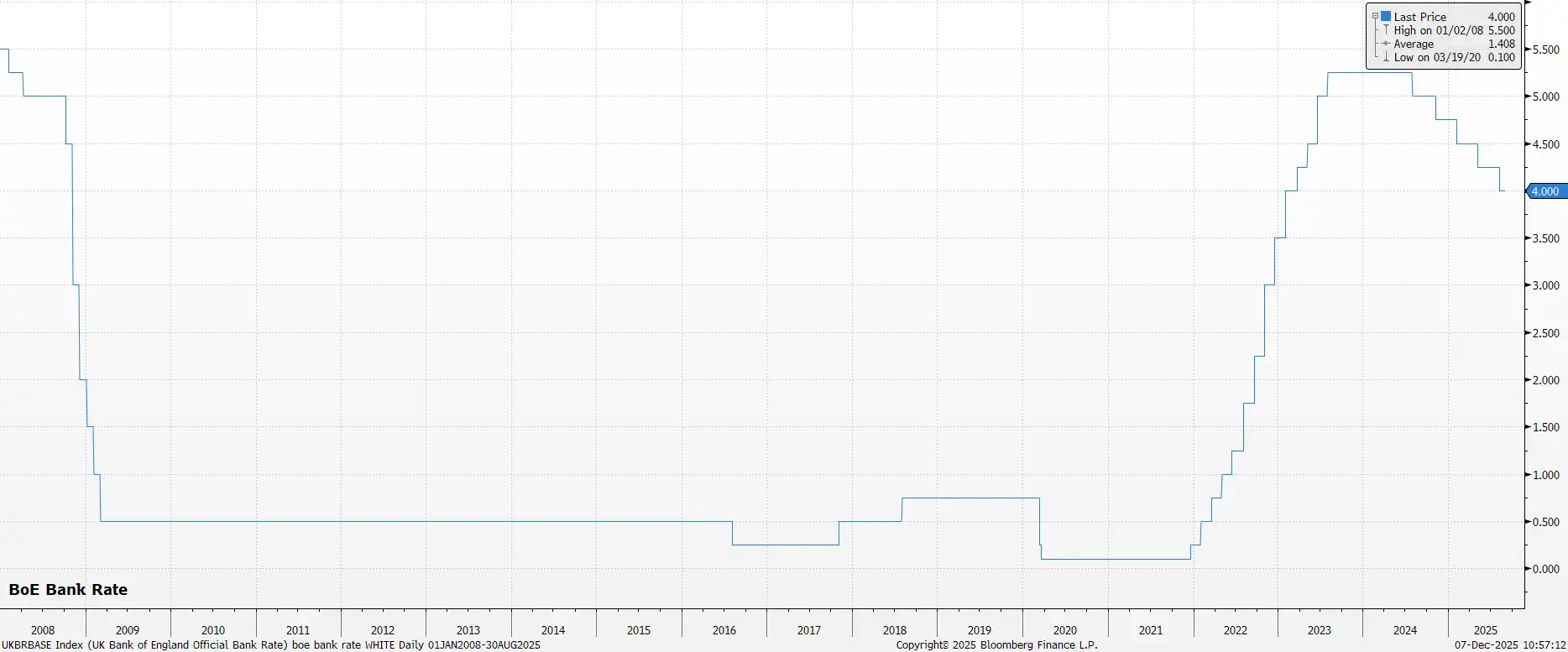

Despite these political risks, the Bank of England's Monetary Policy Committee are set to continue to remove policy restriction. A 25bp cut at the final meeting of 2025 seems near-certain, with another such cut in February 2026 also likely. The key debate for 2026 will centre around where the terminal rate likely lies, with BoE models pointing to neutral sitting around 3.50%, though the GBP OIS curve currently prices Bank Rate bottoming out around 3.25%.

Clearly, with risks to growth tilted to the downside, risks to this policy path tilt rather firmly towards a potentially more dovish outturn as well.

EUR

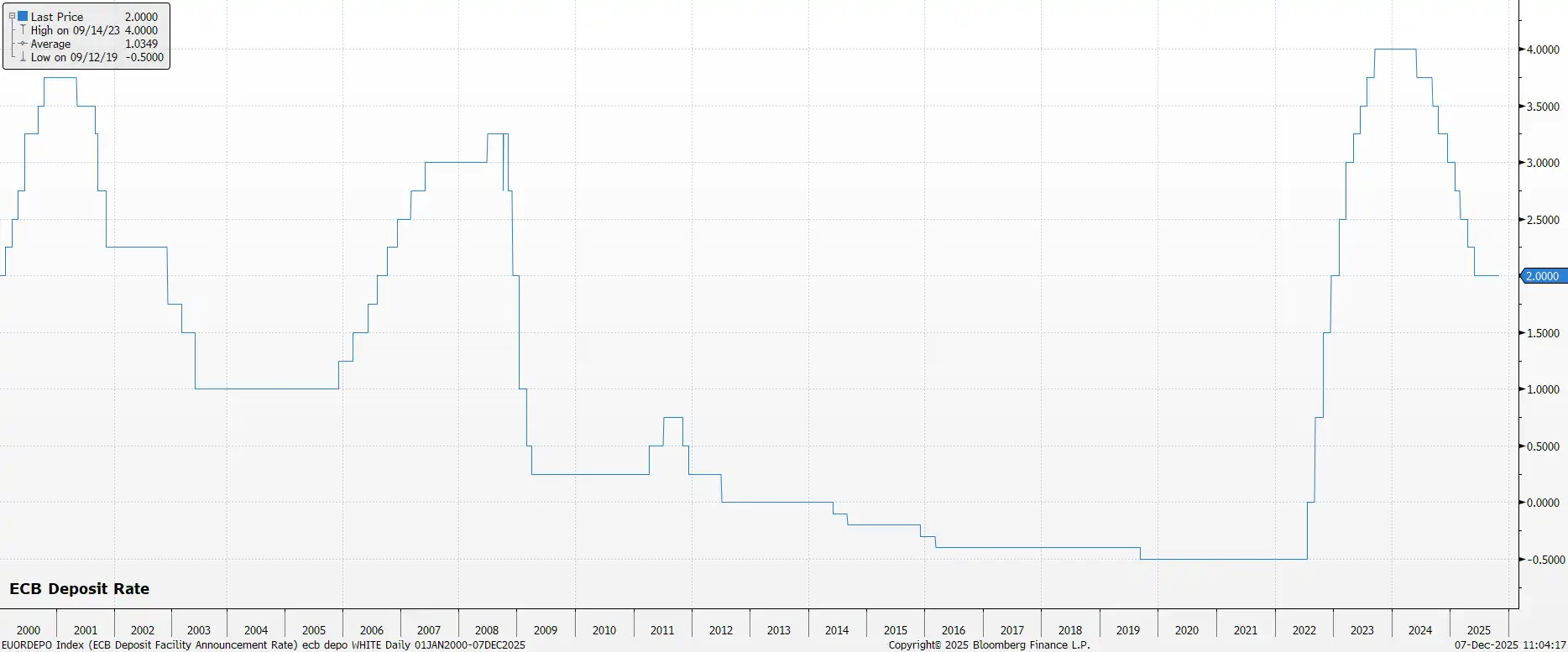

The last year has been a tumultuous one for the eurozone economy where, despite the ECB having continued to ease policy in H1, overall activity has remained somewhat sluggish, largely a result of continued trade and geopolitical uncertainty.

However, 2026 should see the alleviation of trade uncertainty see the matter become a macro tailwind, while long-overdue looser fiscal policy, and a relatively easy ECB stance also support a rosier outlook for the year ahead.

Despite that economic turbulence, the EUR is on track to end the year with gains of around 10% against the greenback, though as with the GBP, that move owes considerably more to the broadly softer USD tone than anything more specifically-related to the bloc itself.

Turning to the year ahead, having been on pause since this cycle's most recent 25bp cut in June 2025, and with the deposit rate now bang in the middle of the ECB's range of estimates for the neutral rate, at 2.00%, policymakers are likely to see little reason to shift from the present 'wait and see' approach.

Interestingly, that 'good place' is one that, per the most recent staff macroeconomic projections, leads to an undershoot of the 2% inflation target in both 2026 and 2027, suggesting that such an undershoot can be tolerated as the 'price' to pay in order to provide continued support to the economy at large. The base case is that 2.00% stands as the deposit rate's terminal level, before the narrative turns to when modest rate hikes could begin in 2027.

Given the 'status quo' nature of the monetary outlook, it is again fiscal policy that is likely to dominate the narrative in the year ahead, with the deficit likely to balloon significantly over the coming twelve months, bringing with it a sizeable eurozone-wide economic tailwind. Said increase in government spending will come, in large part, from Germany, principally from a significant uplift in defence and infrastructure spending, as well as numerous tax changes including greater relief for higher earners and increased child tax allowances.

The broader eurozone macro backdrop is likely to turn increasingly constructive over the course of the year ahead. Trade is the most obvious catalyst, where uncertainty continues to lift in the aftermath of the US-EU trade deal agreed during the summer.

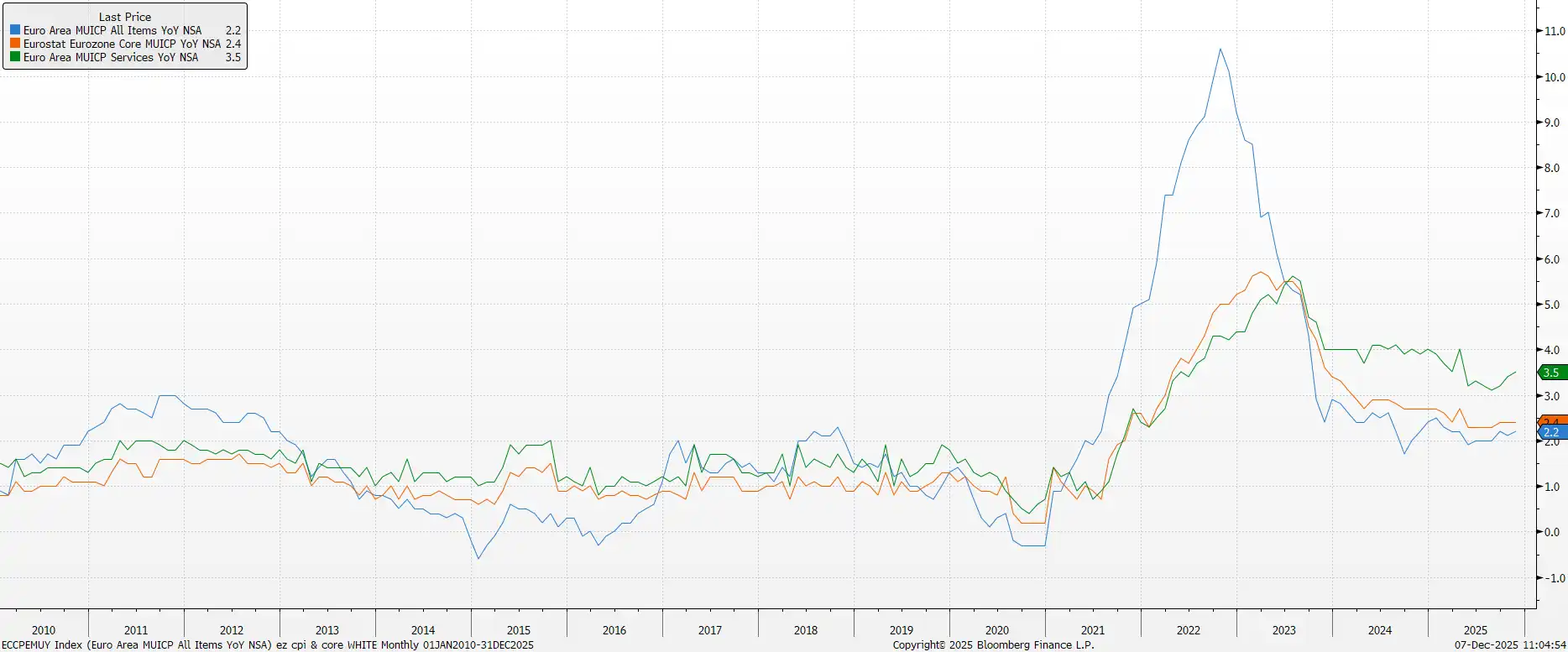

On inflation, headline prices are set to undershoot the ECB's 2% target for a period, beginning in the first quarter of next year, when a significant base effect from energy prices will exert substantial downwards pressure. Labour market momentum has held up relatively well, with headline unemployment having been below 6.5% for the last 18 months, and fiscal tailwinds should support continued consumer spending.

Although the outlook for 2026 is considerably more constructive, numerous risks remain on the horizon. Trade remains an obvious theme where implementation of the US-EU agreement could prove a potential stumbling block.

Political risks also remain plentiful, most notably in France where PM Bayrou remains in a fragile position, while focus will increasingly turn towards a busy year of elections in 2027. Other risks stem from the geopolitical realm, where a durable Russia-Ukraine peace agreement still seems far away.

USD

The words 'trade', 'Trump' and 'turbulence' pretty accurately sum up how the US economy has evolved over the course of the last year, though by and large the private sector has succeeded in 'muddling through' despite a huge amount of uncertainty clouding the outlook.

Said uncertainty should begin to lift in 2026, with the Trump Admin's policy approach now largely set, and with the FOMC set to continue to remove policy restriction, as the fed funds rate falls back to a neutral level.

However, while the private sector may have ‘muddled through’ that uncertainty, the dollar has fared considerably worse, not only being on track to end the year in the red against all G10 peers, but with the dollar index (DXY) having also fallen well over 10% from its best levels of the year, which were seen in early-January.

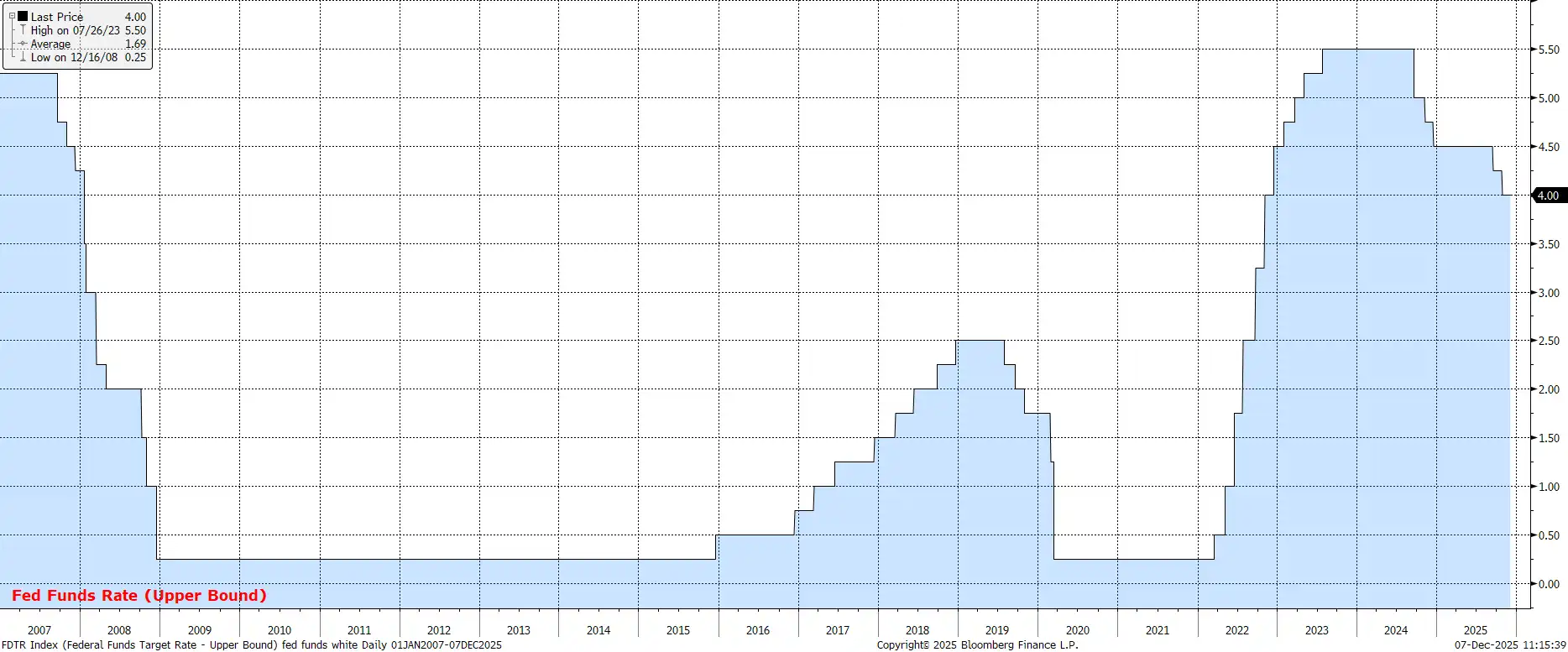

Having already delivered two 25bp cuts in September and October, plus with another such cut likely at the December meeting, it seems plausible that the FOMC are approaching the stage where a majority of policymakers view present downside risks to the labour market as having been adequately managed. That said, the direction of travel for the fed funds rate clearly remains lower, with further cuts returning the rate to a more neutral level of roughly 3%. Importantly, the FOMC's two primary policy levers are now working in tandem, with resumed balance sheet expansion likely next year as well.

Personnel changes are also on the horizon next year, with the most obvious of these being Chair Powell's replacement, with all signs currently pointing to NEC Director Hassett getting the top job. While there are concerns over the further erosion of policy independence, Hassett's credentials are not too dissimilar to those of his predecessors, and the overall impact on the policy outlook from a Hassett Chairmanship would likely be limited. Other potential changes include President Trump’s ongoing attempts to fire Governor Cook, as well as another Governor spot possibly opening up if Powell decides to leave the Fed once his term as Chair expires.

Meanwhile, the US economy has increasingly resembled a 'K-shaped' one in recent years, with a significant divide between those at the upper- and lower-ends of the income spectrum. Consumer spending proved resilient throughout 2025, and should remain so in 2026, with corporate capex on technology providing a further boost.

Aiding both factors is a policy backdrop that should prove considerably more stable, especially in the run-up to the midterm elections in November. 2026 will see the fiscal loosening provided by the 'One Big Beautiful Bill Act' finally start to take effect, acting as a strong tailwind for growth. Meanwhile, immigration enforcement will likely remain at the current high level, leading to continued labour supply constraints, while tariffs are also likely to remain in place at an average rate of around 15%.

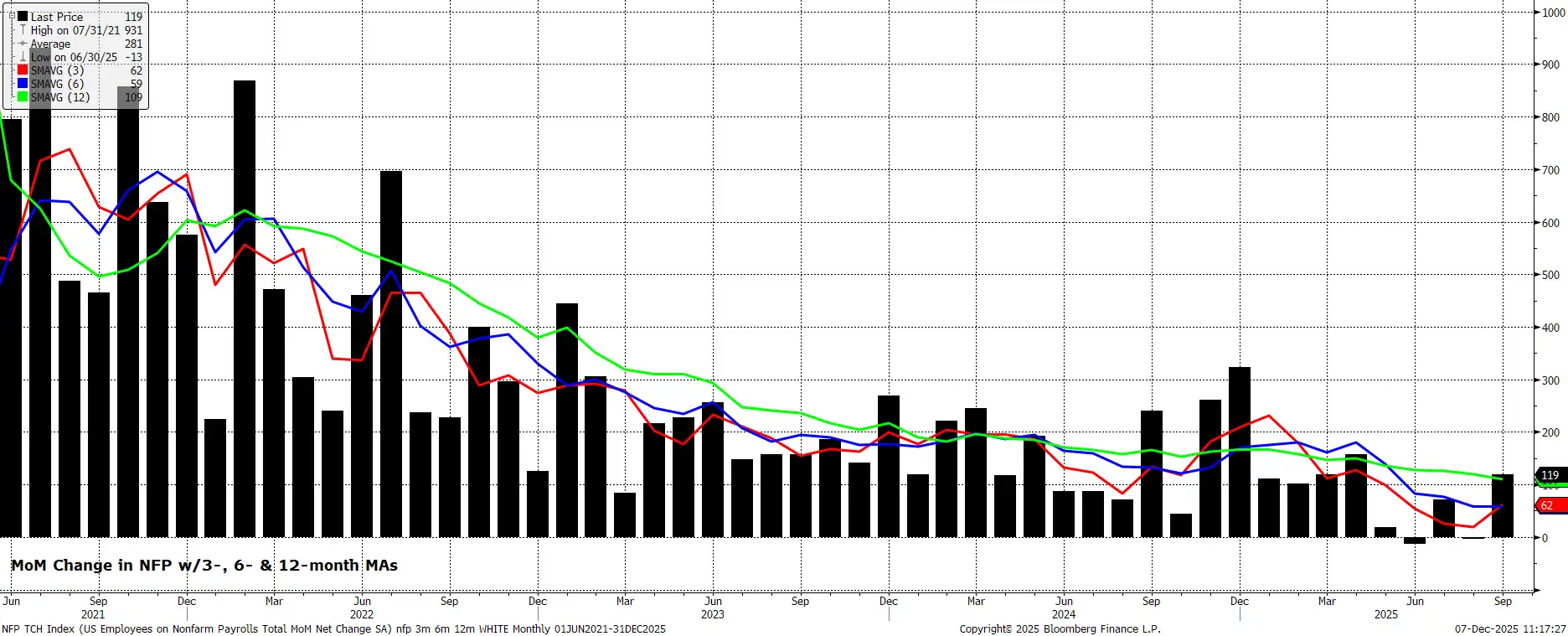

On the subject of the labour market, although conditions have clearly weakened through the second half of 2025, there remain few signs of structural issues. It's plausible to expect this 'muddling through' labour market turns into one which sees a notable pick-up in hiring activity next year, amid an increasingly certain policy backdrop and looser monetary policy environment, though the breakeven pace of payrolls growth is likely to remain in the 30k-70k region.

Meanwhile, though inflation has clearly moved higher over the last twelve months, the inflationary impact of the Trump Admin's trade policies has not proved as bad as initially feared. Rates of headline inflation are likely to peak in the first half of the year, though the journey back towards 2% will not be swift, with the Fed's inflation aim unlikely to be sustainably achieved until 2027.

Sell-Side Year Ahead Forecasts

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.