Tokyo intervention talk lifts yen, Westminster turmoil weighs on sterling, dollar faces historic data week as shutdown delays stack NFP, CPI, retail sales.

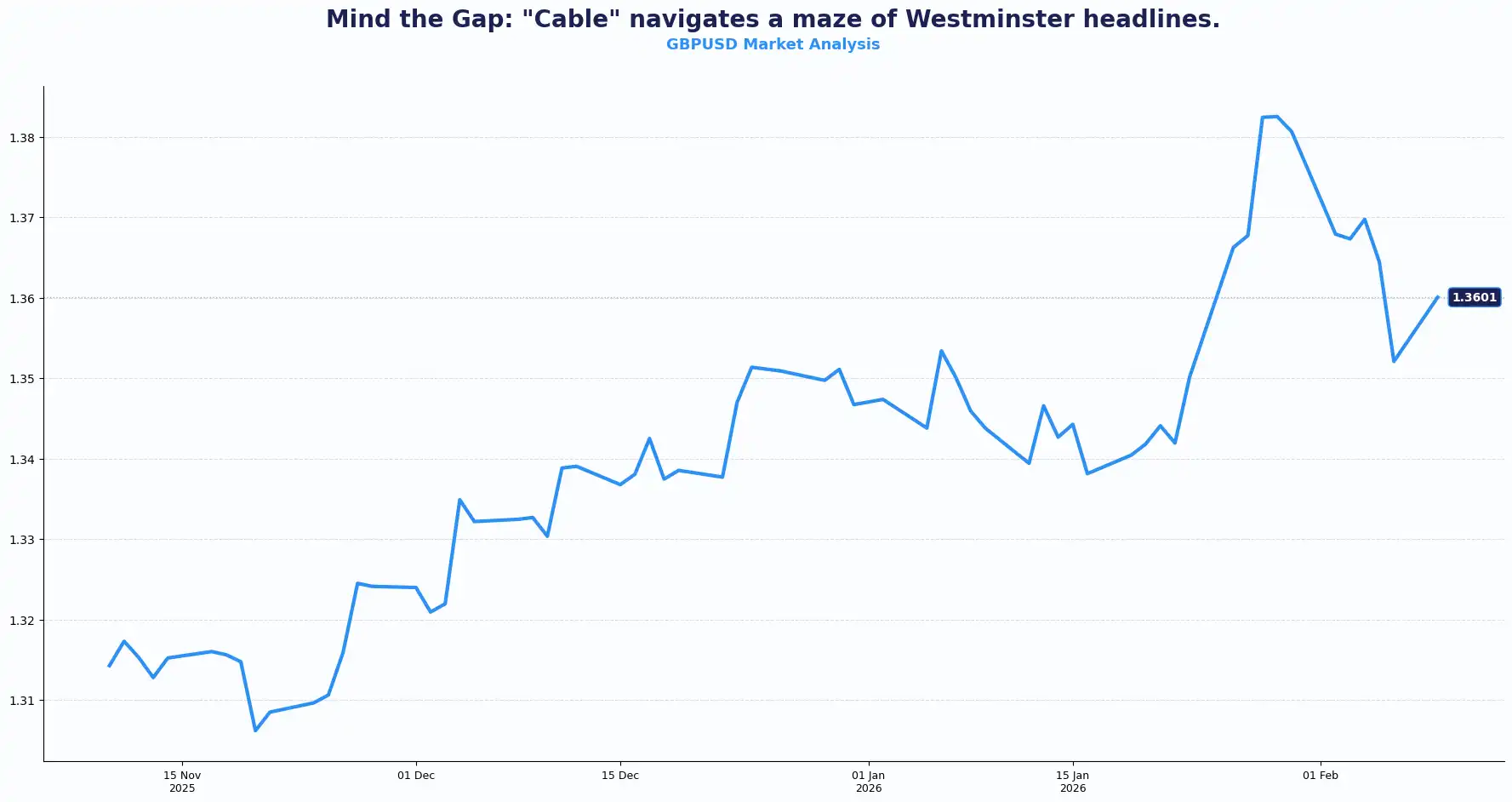

GBP: Starmer Crisis Weighs on Sterling

GBP/USD softened near 1.3610 as political uncertainty in Westminster persists. Prime Minister Keir Starmer faces mounting scrutiny following the resignation of his chief political adviser over the Mandelson-Epstein affair, setting the stage for a pivotal Labour Party meeting Monday (today) where his leadership will be in the spotlight.

Uncertainty around Starmer's leadership leaves GBP/USD vulnerable to downside, with gilt yields edging higher as investors seek greater risk premium for UK assets. Signs of weakening political stability typically act as a headwind for the currency.

The Bank of England's (BoE) dovish shift has brought forward rate cut expectations, with February's 3.75% hold revealing less support for a pause than projected. Policy guidance now points to a gradual easing path, increasingly pricing in a 25bps cut in March; followed by a prolonged pause. Terminal rate forecasts sit at 3.00% by mid-2027 as inflation targeting takes priority.

Cable lacks clear direction amid twin headwinds i.e. domestic political instability and dovish monetary policy. EUR/GBP edged higher to 0.8710 as traders favoured the euro’s relative political calm over the "Cable" chaos. The UK central bank signalled high chances of a near-term cut to ensure inflation stays sustainably at the 2% target, though Andrew Bailey’s casting vote for a hold suggests a "wait and see" dominant approach for now.

Starmer faces MPs at today’s Parliamentary Labour Party meeting, with gilts prone to bouts of volatility should he be ousted. The absence of a clear successor, as Angela Rayner eyes a potential leadership bid, complicates GBP pricing. Until leadership clarity emerges, sterling's upside stays capped near $1.3650.

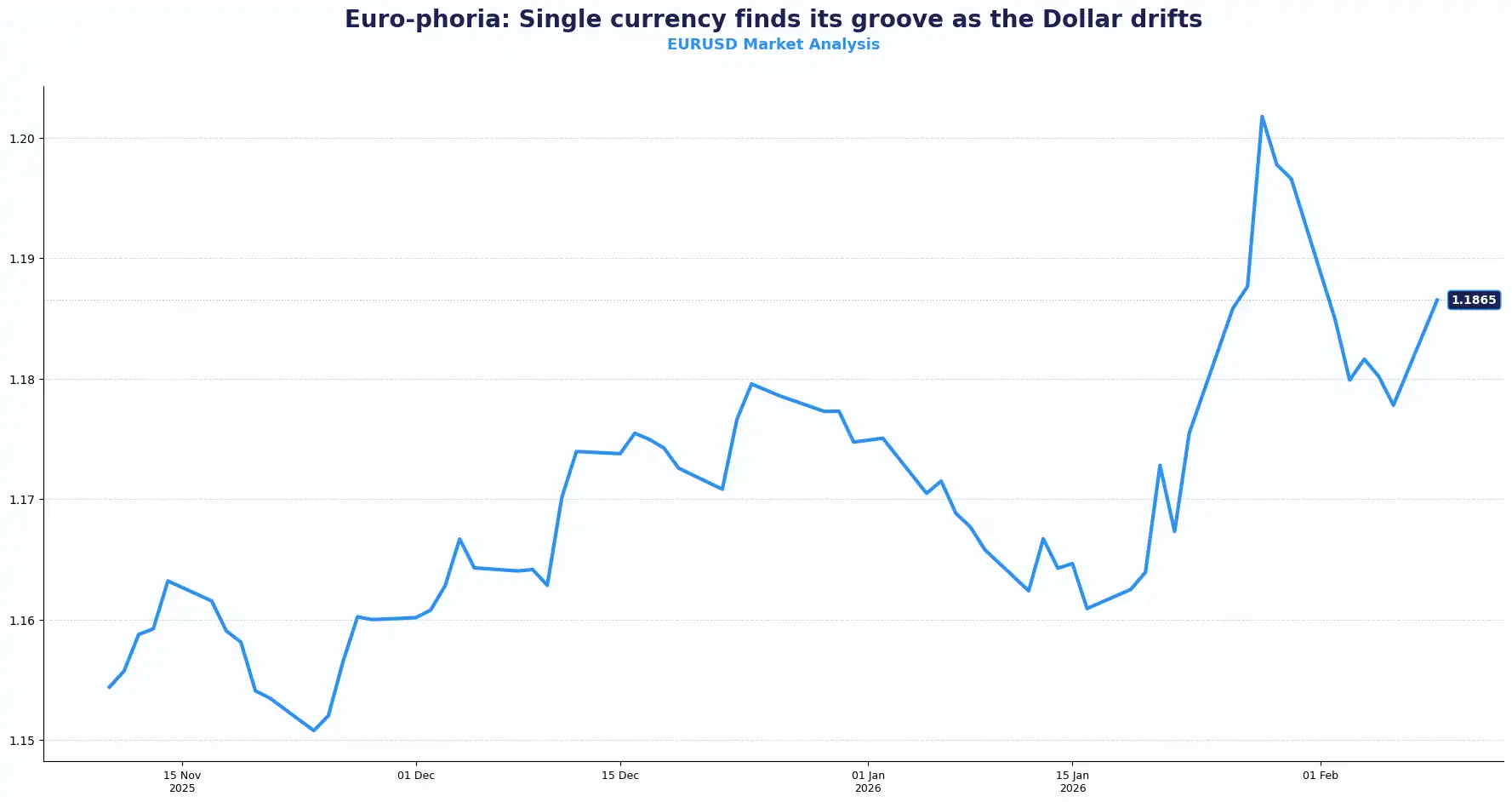

EUR: Single Currency Climbs on Fed-ECB Divergence

The euro rose to $1.1865, building on Friday's bounce from 1.1765 support as traders adjust positions ahead of key US data. Limited Eurozone releases keep focus on central bank divergence, with the single currency supported by expectations of deeper Fed cuts against a slower ECB easing cycle. Ongoing dollar selling drove a second consecutive daily gain for the pair.

Traders favour the euro as US Treasury yields retreat from recent peaks. The ECB's recent decision to keep interest rates unchanged at 2.0% reconfirms that inflation should stabilise at the target in the medium term.

ECB President Christine Lagarde is scheduled to speak today alongside board member Philip Lane, with markets watching for any signals that might challenge current easing expectations. With no major Eurozone data on the docket, the pair acts as a barometer for risk sentiment. EUR/USD is testing ~1.1850 , a level last tested in the previous quarter. Lagarde has noted that while the exchange rate is not a formal policy target, it is central to growth and inflation projections.

The delayed release of US employment data on Wednesday keeps traders sidelined, with nonfarm payrolls expected to set the tone for directional conviction. Technicals favour further upside if dollar softness continues.

USD: Data Deluge Threatens Dollar Rally

The dollar index (DXY) lingers around 97.60 ahead of a dense cluster of U.S. data releases, with nonfarm payrolls, retail sales, and CPI all due this week. Delays from the government shutdown have compressed key economic indicators into a 72-hour window, raising the risk of simultaneous declines for the first time on record.

January nonfarm payrolls are projected to rise by 70,000, with unemployment holding at 4.4%. Retail sales are seen up 0.4%, while both headline and core CPI are expected to slow to 2.5%.

Current estimates indicate a 19.9% probability of a Federal Reserve (Fed) rate cut in March, from 18.4% last Friday. Since June easing is largely priced in, any upside data surprise would prompt a sharp dollar rally.

Fed officials signal cautious optimism but stay vigilant about inflation. Vice Chair Jefferson sees labour market stabilisation with inflation tracking back toward 2% later this year. San Francisco Fed President Mary Daly warned the economy could shift from “low hiring” to “no hiring” as layoffs rise, while Atlanta Fed’s Raphael Bostic cautioned that inflation has been too high for too long.

Oil retakes $63 on renewed Iran sanctions and weaker dollar

WTI crude reclaims $63.00 as fresh US sanctions on Iran offset easing Middle East tensions. Indirect US-Iran nuclear talks concluded Friday with a diplomatic path maintained. Iran's Foreign Minister Araghchi called the eight-hour session a "good start in a good atmosphere." President Trump confirmed another meeting early this week.

The relative dollar weakness and supply restrictions support crude despite reduced geopolitical premium. The AUD/USD climbs 0.4% to 0.7043, just below three-year highs at 0.7094. AUD/JPY hits a 36-year peak of 110.7 as yen weakness persists despite Monday's moderate gains.

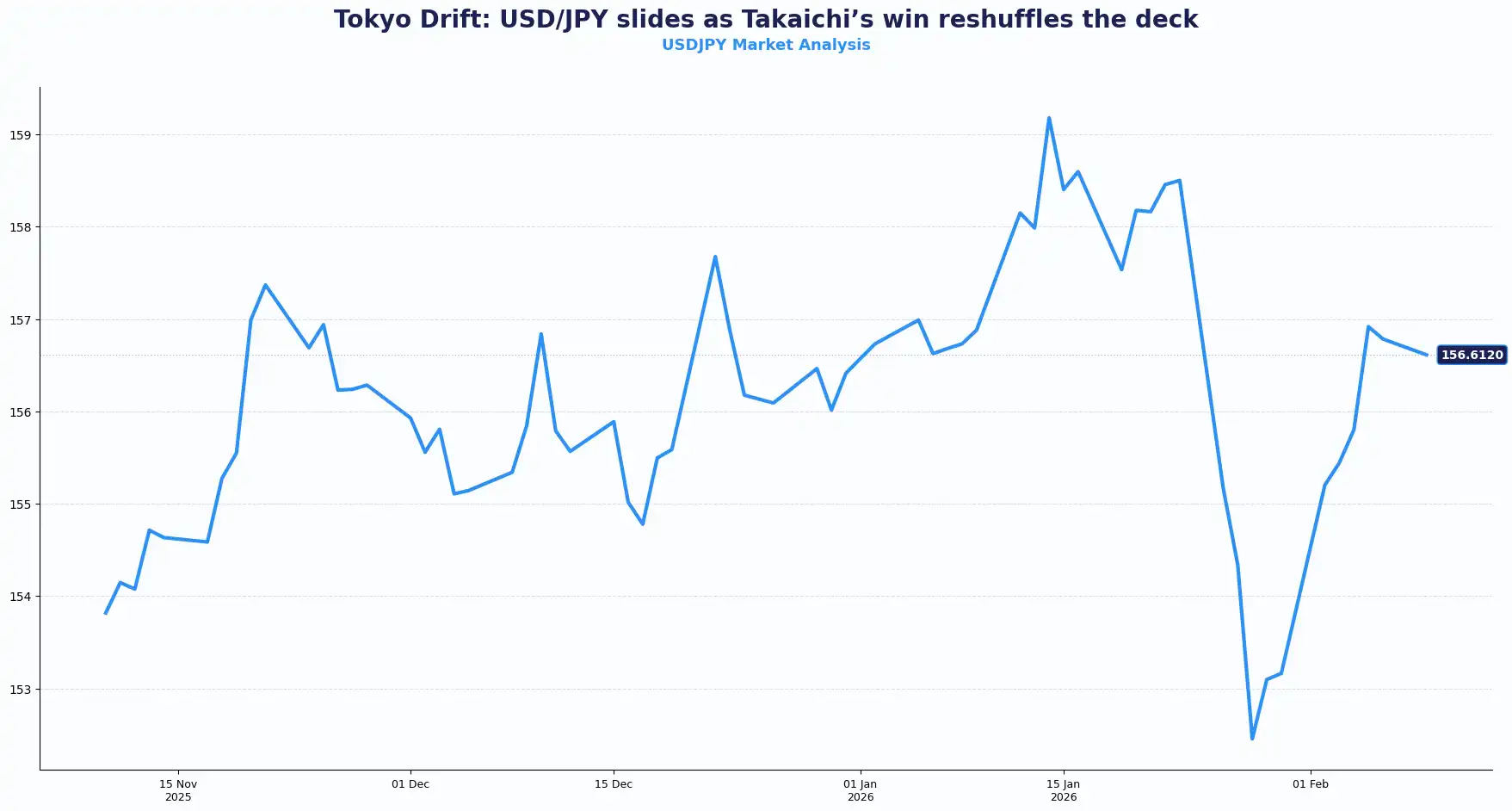

USD/JPY appreciated by 0.5% to 156.43 during Asian trading on Monday, reflecting renewed concerns regarding potential Japanese intervention. The yen initially weakened following Takaichi’s immediate election landslide announcement. Tokyo's chief currency official, Mimura, stated that authorities are "closely watching with a high sense of urgency" after Takaichi's victory. The yen subsequently reversed a six-day losing streak despite ongoing concerns about fiscal expansion, as official verbal intervention limited further depreciation.

JPY: Takaichi Supermajority Shifts Focus to Fiscal Policy

Prime Minister Sanae Takaichi's Liberal Democratic Party (LDP) won 328 of 465 lower house seats, securing a supermajority with coalition partner Ishin. The result removes near-term political uncertainty but raises the risks of fiscal expansion. Investors are now watching whether stimulus measures, including cuts to food consumption taxes, could prompt the Bank of Japan (BoJ) to bring forward further rate hikes.

Cross-asset volatility is running high as Japanese two-year yields hit 1.3%, the highest level since 1996. Equities welcomed the stability of a strengthened LDP mandate, though the prospect of debt-funded spending puts JGBs under intense pressure. Global risk appetite recovered through the Asian session, supporting antipodean currencies and dragging on the greenback.

Finance official Katayama maintains close contact with US Treasury Secretary Bessent on USD/JPY stability. Near-term intervention risk caps dollar-yen gains, though a longer-term fiscal expansion outlook pressures the currency. Japan gains political stability with a prime minister likely to serve beyond the typical one-to-two year churn.

Markets look ahead:

-

Monday, 9 Feb: ECB Lagarde speech; UK Labour Party meeting, Japan post-election meeting

-

Wednesday, 11 Feb: US Nonfarm payrolls, US Unemployment rate data

-

Friday, 13 Feb: US CPI, US Retail sales data

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.