GBP/USD hovered near 1.2450 as the Bank of England (BoE) slashed interest rates by another 25 basis points, aligning with the highly anticipated rate decision, which exerted pressure on the pound. BoE Governor Andrew Bailey has advocated for a cautious and gradual approach to further rate cuts amidst projections that inflation may rise to 3.7% in the third quarter of the year due to increased energy prices before reverting to the 2% target. The BoE has also lowered its Gross Domestic Product (GDP) growth forecast for 2024 to 0.75%, down from the 1.5% anticipated in November. Moreover, the BoE's monetary policy report showed broad agreement among policymakers on the need for additional policy easing, with two members, Swati Dhingra and Catherine Mann, advocating for a larger-than-usual 50-basis point rate cut. This has fueled market speculation that the BoE could ease by 65 basis points by the end of 2025.

On the other hand, a larger-than-expected rise in unemployment claims, coupled with deteriorating market sentiment, drove demand for safe-haven assets, which negatively impacted the US Dollar. The US economy added approximately 170,000 jobs in January, a significant decline compared to 256,000 in December. The unemployment rate is expected to remain steady at 4.1%, indicating resilience in the labour market despite ongoing economic challenges. Average Hourly Earnings are anticipated to decline to 3.8% year-on-year in January, down from 3.9%. Furthermore, the hawkish tone of Federal Reserve (Fed) officials could provide additional support to the US Dollar. On Thursday, Chicago Fed President Austan Goolsbee noted, "Added uncertainty makes the environment for the Fed foggier," suggesting a need to slow the pace of rate cuts. He further stated that the neutral rate is likely below current Fed policy, but it is appropriate to slow the pace of cuts to find a stopping point.

Apart from Bailey's speech, market participants will closely watch the Nonfarm Payrolls (NFP) jobs data, the Prelim University of Michigan Consumer Sentiment, and the Prelim University of Michigan Inflation Expectations figures, which will play a crucial role in determining the direction of GBP/USD.

EUR/JPY Rebounds as Weakened Yen Follows IMF Remarks

EUR/JPY recovered to 157.78, as cautious comments from an International Monetary Fund (IMF) official softened the yen. On Friday, Gita Gopinath, First Deputy Managing Director of the IMF, remarked that "Japan's services inflation remains below the 2% target, which is why it remains appropriate for the Bank of Japan (BoJ) to maintain accommodative monetary policy." The IMF also cautioned Japan to remain vigilant to the potential spillover effects of increased volatility in global markets, which could impact liquidity conditions for its financial institutions. Additionally, the IMF warned of the risks associated with the BoJ's rate hikes, including the rising burden of government debt servicing and the increased likelihood of corporate bankruptcies.

In remarks made on Thursday, Kazuhiro Masaki, the Director General of the BoJ's monetary affairs department, confirmed that the central bank would continue to raise interest rates if underlying inflation accelerates towards the 2% target, creating a considerable differential compared to the European Central Bank's (ECB) dovish stance.

On the economic front, Germany's Industrial Production fell by 2.4% in December, compared to a 1.3% rise in November, missing the forecasted -0.7%. However, Germany's trade surplus widened to EUR 20.7 billion in December, up from a revised EUR 19.2 billion in November, exceeding the EUR 17 billion estimate and marking the largest surplus since August. Exports unexpectedly rose by 2.9% month-on-month to EUR 131.7 billion, an eight-month high, surpassing expectations of a 0.6% decline. Imports rose by 2.1% to EUR 111.1 billion, surpassing the forecast of 1.8% growth. In December, Germany's industrial orders increased by 6.9%, recovering from a 5.2% decline in November and surpassing the 2% forecast. However, year-on-year industrial orders dropped by 6.3% in December, marking a steeper decline than the previous 1.4%.

In the upcoming sessions, concerns that President Trump may impose tariffs on goods from the European Union, dovish sentiment surrounding the ECB's policy outlook, and market reactions to IMF remarks will likely influence the EUR/JPY exchange rate.

EUR/USD Wobbles Amid Risk Aversion

EUR/USD softened near 1.0393, as rising uncertainty surrounding US trade policy towards the Eurozone and a general risk-off sentiment pressured the euro. Over the weekend, President Trump warned that Europe would face tariffs for not purchasing enough American goods. In response, EU leaders have vowed to retaliate if these tariffs are imposed. ECB policymaker Piero Cipollone commented that the central bank remains poised to cut interest rates further as inflation eases. He also cautioned that escalating trade war tensions could negatively impact the Eurozone's economic stability.

Germany's Industrial Production dropped 2.4% in December, missing the expected 0.7% decline. However, Germany's trade surplus widened to EUR 20.7 billion, surpassing forecasts, with exports rising by 2.9% to EUR 131.7 billion, an eight-month high. Imports increased by 2.1%, exceeding the forecasted 1.8% growth. Germany's industrial orders surged by 6.9% month-on-month, recovering from November's 5.2% decline and exceeding the 2% forecast. However, year-on-year industrial orders fell by 6.3%, a sharper drop than the prior 1.4%. Meanwhile, the French trade deficit narrowed to EUR 3.9 billion in December, down from EUR 6.3 billion in November. Exports increased by EUR 0.8 billion to EUR 51.2 billion, while imports rose by EUR 0.2 billion to EUR 56.4 billion month-on-month.

The US Dollar climbed on Thursday as a decline in market sentiment fuelled demand for safe-haven assets. However, gains were limited after the latest US initial jobless claims report showed a larger-than-expected rise in unemployment claims for the week ending 31 January, reaching 219,000, surpassing the initial estimate of 213,000. The US NFP report for January is expected to show a job increase of 170,000, down from 256,000 in December. The unemployment rate is expected to hold steady at 4.1%. Attention will also be on Average Hourly Earnings, which are forecast to decelerate to 3.8% year-on-year from 3.9%, with monthly growth expected to remain steady at 0.3%.

In today's session, broader market sentiment surrounding the US NFP data and Germany's industrial production figures will drive the EUR/USD exchange rate.

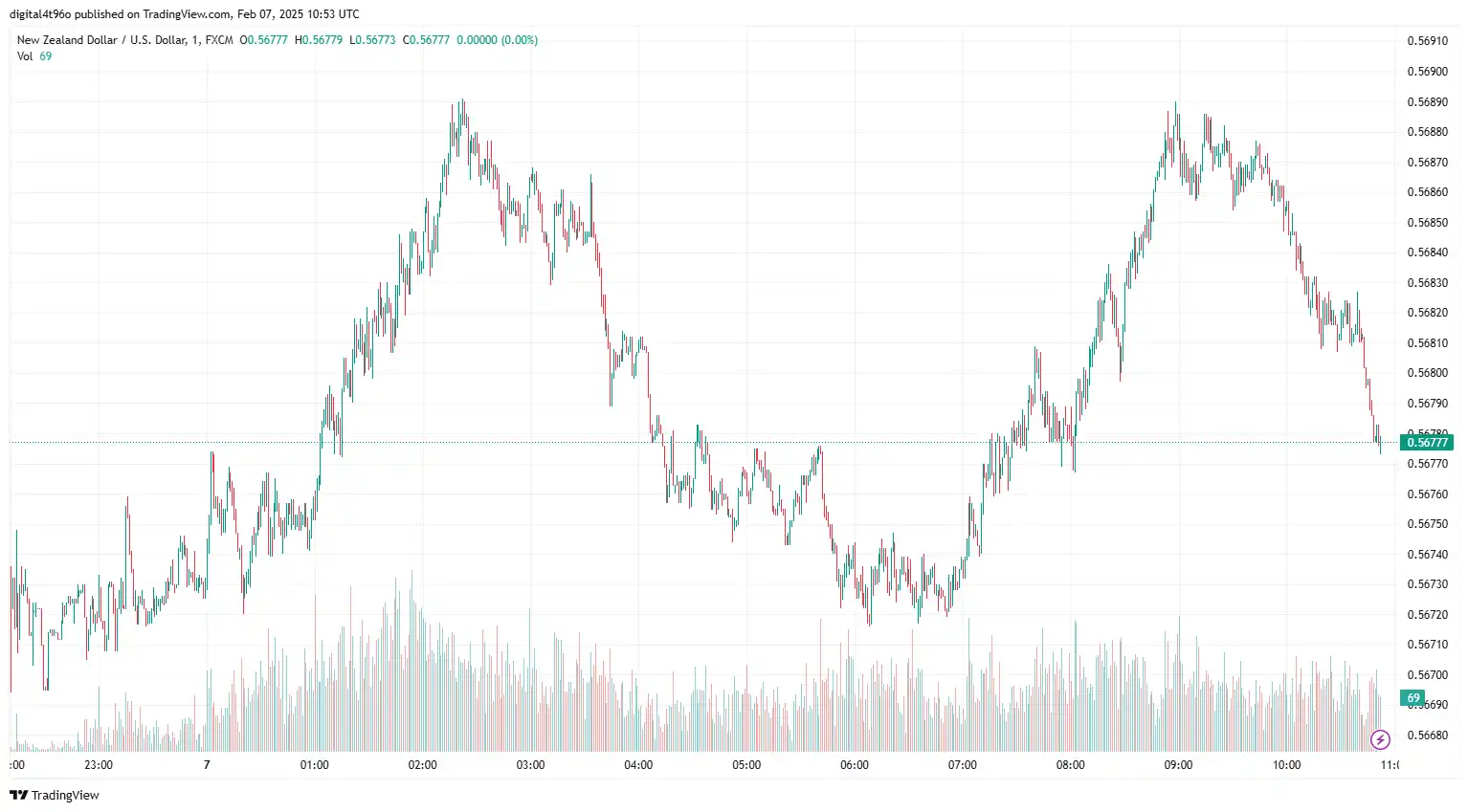

NZD/USD Buoyed Ahead of US NFP

NZD/USD remains steady at 0.5683 amid elevated risk aversion due to global trade and economic tensions. On Wednesday, China filed a challenge with the World Trade Organization (WTO) against US President Trump's new 10% tariff on Chinese imports and the withdrawal of a duty-free exemption for low-value packages. The move comes as China accuses the US of "protectionist" actions that breach WTO rules. Investors are closely monitoring the rising tensions between the world's two largest economies. Any signs of further escalation could pressure the New Zealand Dollar, a close trading partner of China.

New Zealand's unemployment rate rose to 5.1% in Q4 2024, which is in line with market expectations. The employment rate fell to 67.4% from 67.7%, while the underutilisation rate increased to 12.1% from 11.6%. Market expectations are growing for a 50-basis point rate cut by the Reserve Bank of New Zealand (RBNZ) in an upcoming policy meeting, which could place further pressure on the NZD.

Meanwhile, the US Dollar is gaining support from the hawkish stance of Fed officials and the anticipation of upcoming labour market data. Chicago Fed President Austan Goolsbee noted that prevailing uncertainty is clouding the Fed's outlook, suggesting a more cautious approach to rate cuts. Fed Vice Chairman Philip Jefferson also highlighted that uncertainties surrounding President Trump's policies would impact the Fed's strategy. Nevertheless, the strong US economy enables a measured and careful approach to future policy easing.

On the data front, US initial jobless claims rose to 219,000 for the week ending 31 January, surpassing estimates. The US ISM Services PMI fell to 52.8 in January, missing the forecast of 54.3. Additionally, January's NFP and any significant developments in the US-China trade conflict will influence the NZD/USD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.