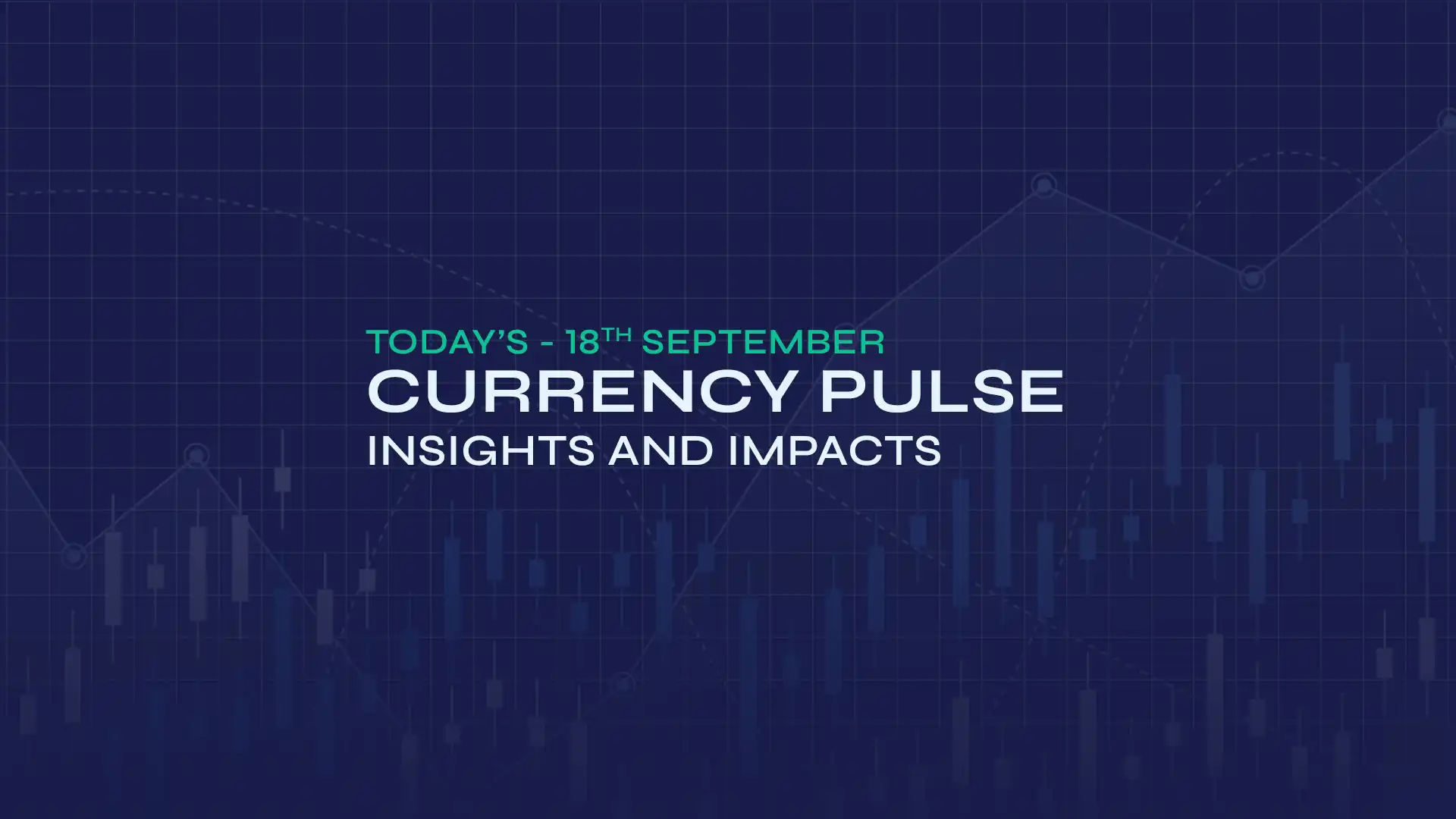

GBP/JPY recovered near 196.47 amid a broad sell-off in UK assets, driven by increasing uncertainty and political and fiscal jitters, which dampened market sentiment around the pound. Prime Minister Keir Starmer was compelled to scale back his government's welfare reform plan after a significant rebellion within his party. Nearly 50 Labour MPs voted against the bill, leading to a retreat that nullified billions in expected savings and heightened concerns over how the government will balance the budget. Markets were also unsettled by speculation regarding the future of Chancellor Rachel Reeves, who appeared visibly upset during Prime Minister's Questions. Although reports confirmed she has the full support of the Prime Minister, he stopped short of guaranteeing she would remain Chancellor at the next election. This uncertainty further unsettled markets, as investors worry about the stability of the UK's leadership and economic trajectory. On Wednesday, 10-year UK gilt yields jumped nearly 4% to around 4.61% after Chancellor Reeves announced a new welfare scheme at the House of Commons on Tuesday. On the monetary policy front, Bank of England (BoE) policymaker Alan Taylor has advocated for five interest rate cuts this year, exceeding the four cuts expected by market participants, citing downside economic risks in 2026 due to weak demand and trade disruptions. The S&P Global UK Services PMI Business Activity Index registered 52.8 in June, rising from 50.9 in May and marking the highest figure in 10 months. The seasonally adjusted S&P Global UK PMI Composite Output Index reached 52.0, up from 50.3 in May, its fastest rate since September 2024.

On the yen's front, increasing global risk stemming from the trade agreement between the US and Vietnam eased concerns over prolonged trade tensions, undermining the safe-haven yen. US President Trump's recent warning to impose a 30% or 35% tariff on Japan and not to extend the self-imposed July 9 deadline for the suspended reciprocal tariffs also weighed on the yen. Bank of Japan Governor Kazuo Ueda stated on Tuesday that the current policy rate is below neutral, and future interest rate increases will depend on inflation trends. Japan's consumer inflation has stayed above the BoJ's 2% target for over three years as companies continue passing on higher raw material costs. BoJ Board Member Hajime Takata mentioned on Thursday that Japan is nearing its inflation goal but hasn't fully reached it yet, so an accommodative monetary policy remains necessary. He also noted that the central bank is currently pausing its rate hike cycle and should continue to shift gears after a period of 'wait and see.' Regarding tariffs, he commented that the impact of US tariff policies will likely dampen Japan's economy through channels such as a slowdown in overseas economies, a dip in domestic corporate profits, and a related slowdown in wage growth.

Broader market sentiment amid uncertainty over the future of UK Chancellor Rachel Reeves and the S&P Global UK Services PMI will drive the GBP/JPY exchange rate.

AUD/USD Hovers Ahead of Nonfarm Payrolls

AUD/USD fluctuated near the 0.6581 range following the improved market mood after the release of Australian trade data and China's services PMI. Australia's trade surplus shrank to 2,238M in May, below the 5,091M expected and down from 4,859M (revised from 5,431M) in the previous reading, according to the latest foreign trade data published by the Australian Bureau of Statistics on Thursday. Further details show that Australia's exports declined by 2.7% month-on-month in May, compared to a revised 1.7% decrease (from -2.4%) in April. Meanwhile, imports increased by 3.8% month-on-month in May, up from a revised 1.6% rise (from 1.1%) in April. Retail sales increased by 0.2% month-on-month in May, compared to a flat 0% in April (revised from -0.1%). The figure fell short of market expectations of 0.4%. Meanwhile, building permits rose by 3.2% in May, reversing the prior decline of 4.1%, but did not meet the anticipated 4.8% rise. China's Services Purchasing Managers' Index (PMI) fell to 50.6 in June from 51.1 in May, missing the market forecast of 51.

On the greenback front, investors are looking forward to US Nonfarm Payrolls (NFP) and Average Hourly Earnings for fresh insights on the US dollar. The labour market report is expected to show that 110,000 jobs were added to the US economy in June, down from 139,000 in May. Meanwhile, the unemployment rate is expected to increase slightly to 4.3%, up from 4.2% in May. US Treasury Secretary Bessent stated in a late Tuesday interview that he expects the Federal Reserve (Fed) to cut interest rates before the autumn, with a definite rate cut by September at the latest. Meanwhile, Federal Reserve Bank of Richmond President Tom Barkin reaffirmed in a Wednesday interview that the Fed is not in a hurry to lower interest rates, despite the possible consequences of tariffs imposed by the Trump administration. Recent data from the US Bureau of Labour Statistics (BLS) shows that 7.769 million job openings were available on the last business day of May, as reported by the Job Openings and Labour Turnover Survey (JOLTS) on Tuesday. This figure is higher than April's 7.395 million openings and also surpasses the market forecast of 7.3 million. In June, US manufacturing activity experienced a slight uptick, with the ISM Manufacturing PMI increasing to 49.0 from 48.5 in May, exceeding analysts' expectations of 48.8. The Employment Index decreased slightly to 45.0 from 46.8 in May, indicating some challenges in payroll growth. Meanwhile, the Prices Paid Index, which measures inflation, rose slightly to 69.7 from 69.4. Additionally, the New Orders Index fell to 46.4 from 47.6.

Today's US Nonfarm Payrolls (NFP), Average Hourly Earnings, ISM Services PMI, and S&P Global US PMI will influence market sentiment regarding the AUD/USD exchange rate.

EUR/JPY Climbed Due to the BoJ's Caution on Rate Hikes

EUR/JPY edged higher to 169.73 due to the Bank of Japan's (BoJ) caution on unwinding its ultra-loose policy, diminishing the market anticipation of early interest rate hikes, which weighed on the yen. US President Donald Trump stated on Tuesday that he is contemplating imposing an extra 30% or 35% tariff on Japan and is unlikely to extend the self-imposed July 9 deadline for the currently suspended reciprocal tariffs. Trump also expressed doubt about the possibility of reaching an agreement with Japan. Bank of Japan Governor Kazuo Ueda stated on Tuesday that, although headline inflation has remained above 2% for nearly three years, underlying inflation continues to be below the target. He emphasised that any future rate increases will depend on the overall inflation trend, including wage growth and expectations. Additionally, BoJ's new board member Kazuyuki Masu mentioned that the central bank should avoid rushing into interest rate hikes amid various economic risks. However, concerns about rising inflation pressures in Japan keep the possibility of a BoJ rate hike in 2025 open, especially if trade risks lessen. BoJ Board Member Hajime Takata also indicated that the bank might resume tightening monetary policy after assessing the impact of US tariffs, noting that the central bank needs to evaluate these effects carefully but could quickly return to rate hikes if US policies change.

In the Eurozone, the HCOB Eurozone Services PMI Business Activity Index increased above 50.5, up from 49.7 in May, indicating a return to growth in services output within the single currency area. Meanwhile, the seasonally adjusted HCOB Eurozone Composite PMI Output Index rose to 50.6 in June from 50.2 in May. The latest Unemployment Rate report increased from 6.2% to 6.3% in May, surpassing estimates based on the previous figure. Eurostat reports that 13.052 million people were unemployed across the EU, including 10.830 million within the euro area. Italy's unemployment rate jumped sharply to 6.5% in May from a revised 6.1% in April, exceeding the forecast of 6.0% and reaching the highest level since June last year. German unemployment rose by 11,000 in June, which was lower than the expected 15,000 and considerably less than the 34,000 increase seen in May. The unemployment rate remained steady at 6.3%, contrary to forecasts of a rise to 6.4%. The HCOB final Services Purchasing Managers' Index increased to 49.7 in June, up from May's 2-1/2-year low of 47.1 and slightly above the initial estimate of 49.4 for June. On Wednesday, ECB policymaker Pierre Wunsch stated, "I am not uncomfortable with the market's interest rate expectations." He added that "There is an argument for providing a mildly supportive policy stance." Meanwhile, ECB member Olli Rehn remarked, "The ECB should be mindful of the risk that inflation remains persistently below the 2% target." Rehn also highlighted that "Joint European borrowing to finance defence could strengthen the euro's role by creating a new safe asset."

In today's session, investors will observe Eurozone HCOB Services PMI data and developments in the EU-US trade deals for fresh impetus on the EUR/JPY exchange rate.

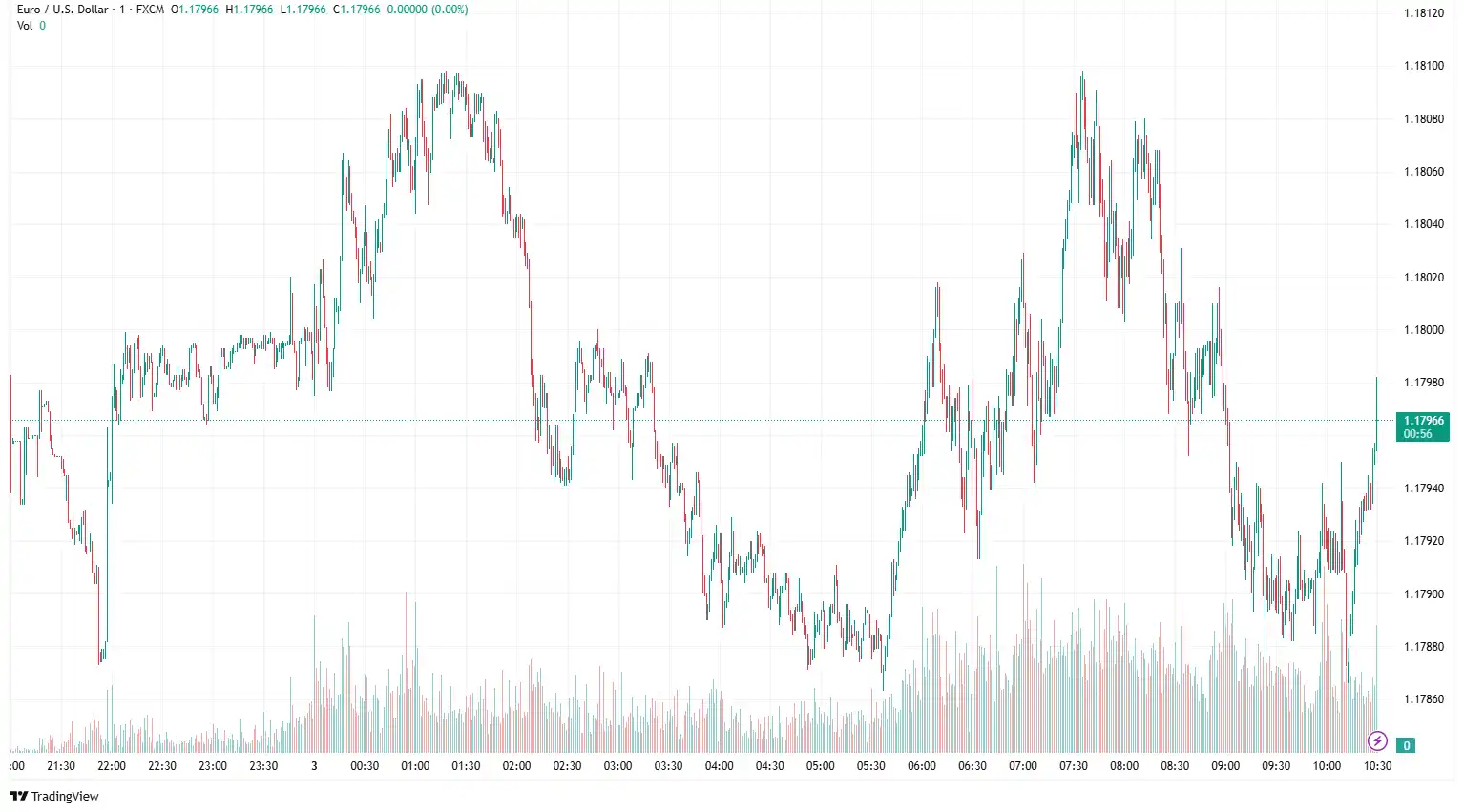

EUR/USD Struggles Following Eurozone PMI Releases

EUR/USD traded near 1.1800, following the release of HCOB Services and Composite PMI reports from Germany and the Eurozone. The Eurozone Services Purchasing Managers' Index (PMI), compiled by S&P Global, rose to 50.5 in June from 49.7 in May, beating the initial estimate of 50.0. The overall PMI, which encompasses both manufacturing and services, rose to 50.6 in June from 50.2, marking a three-month high but still indicating moderate growth. Meanwhile, Germany's final Services PMI improved to 49.7 in June, up from a two-and-a-half-year low of 47.1 in May, and slightly above the preliminary June figure of 49.4. The combined PMI for services and manufacturing in Germany grew to 50.4 in June from 48.5 in May. Spain's Services PMI Business Activity Index increased to 51.9 in June from 51.3 in May, though the pace slowed compared to previous months since February 2024, when all readings were above 53. The HCOB Services PMI for Spain declined to 52.1 in June from 53.2 in May, missing expectations and nearing the 50.0 contraction threshold. The Composite PMI for the Eurozone, which combines manufacturing and services, fell to 51.1 in June from 52.5 in May, marking the lowest level since March. The Eurozone's unemployment rate rose to 6.3% in May from 6.2% in April, slightly above the anticipated 6.2%.

On the USD side, the ADP National Employment Report released on Wednesday indicated that US private payrolls decreased in June for the first time in over two years, strengthening expectations that the Federal Reserve (Fed) may cut rates as early as September. The US Bureau of Labour Statistics (BLS) announced that there were 7.769 million job openings at the end of May, based on the Job Openings and Labour Turnover Survey (JOLTS) released on Tuesday. This volume is higher than April's 7.395 million and also surpasses the market estimate of 7.3 million. In June, US manufacturing activity experienced a slight uptick, with the ISM Manufacturing PMI increasing to 49.0 from 48.5 in May, exceeding analysts' projections of 48.8. However, the Employment Index fell slightly to 45.0 from 46.8, reflecting some payroll growth challenges. Meanwhile, the Prices Paid Index, which gauges inflation, edged up modestly to 69.7 from 69.4. The New Orders Index also declined to 46.4 from 47.6. Traders anticipate that the US NFP will rise by 110,000 in June. The unemployment rate is also expected to edge up to 4.3%, while Average Hourly Earnings are projected to stay steady at 3.9% year-on-year during the same period. The US ISM Services PMI is expected to indicate that the sector's activity has returned to growth in June, with a reading of 50.5 from a slight contraction of 49.9 in May.

Today's US Nonfarm Payrolls (NFP) data for June, US ISM Services PMI and Eurozone HCOB Services PMI will influence the EUR/USD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.