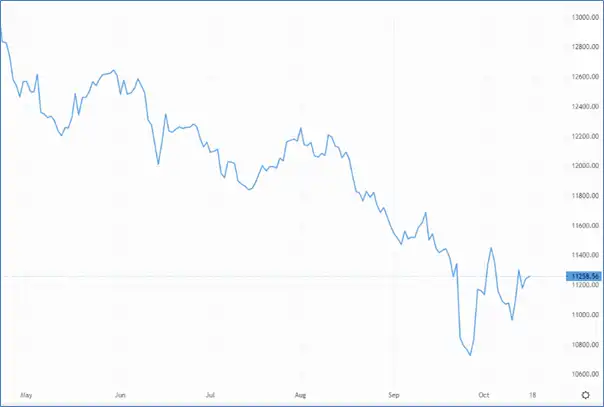

Daily Forex Report 17-Oct-2022: GBP gains on USD while JPY approaches intervention zone

EUR/USD struggling to capitalise on weaker dollar

“As things stand today, my best guess is that inflationary pressures will require a stronger response than we perhaps thought in August,” Bank of England governor Andrew Baily said over the weekend, referring to the next interest rate decision due November 3.

Combine Baily’s comments with confidence among traders in Asia trading hours, and we’ve seen a nearly 1% gain on the GBP/USD pair to US$1.13.

Sterling is up 0.92% against the Japanese yen, 0.74% against the euro, 0.6% against the Canadian dollar, and 0.67% against the Swiss franc.

Sterling’s ongoing strength will no doubt rest on Wednesday’s UK inflaton data, and concrete proof that chancellor Jeremy Hunt intends to fully reverse former chancellor Kwasi Kwarteng’s maligned mini-budget.

GBP/USD makes a move on BoE’s hawkish comments – Source: capital.com

GBP/USD makes a move on BoE’s hawkish comments – Source: capital.com

The EUR/USD pair is struggling to capitalise on broader US weakness; while up 0.2%, the pair faces a challenge in moving above the resistance formed at US$0.98.

Things continue to look grim for the yen, which is trading hands at 148.71 as onlookers weigh up the possibility of another Bank of Japan intervention to resuscitated the G10’s sets problem child.

Surpassing the 149 barrier could be the last straw for the BoJ, making an intervention more than likely.

Understanding your FX risk and exposure is paramount to your bottom line. Contact Currency Solutions today and find out how we can help you with:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

Click here for find out more.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.