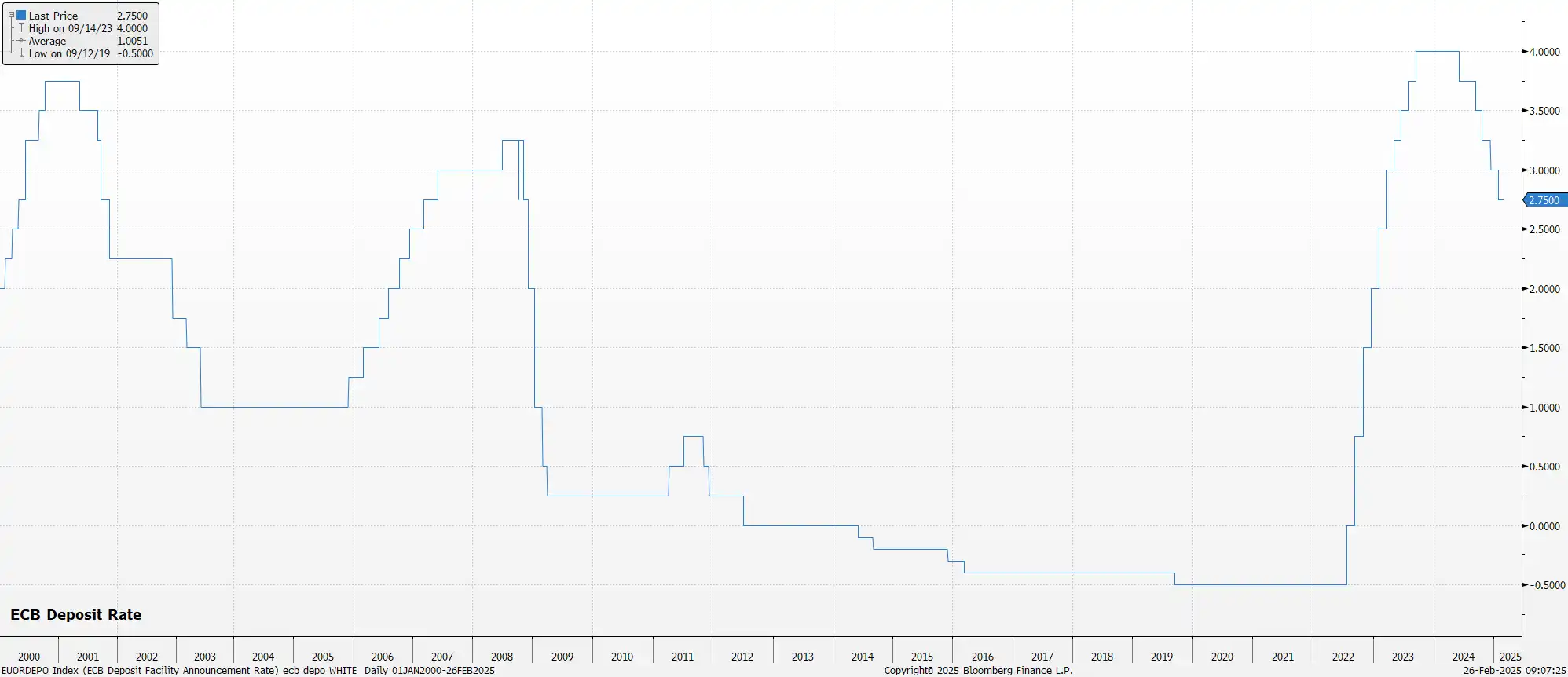

The ECB will likely continue to ease policy at the March meeting, delivering a 25bp cut to the deposit rate, in turn taking rates to 2.50%, marking the sixth rate cut of the cycle. Money markets, per the EUR OIS curve, fully discount such a move at this meeting, though don’t discount another 25bp cut until June.

Accompanying the decision to deliver another cut will likely be policy guidance that is broadly reflective of that issued after the last few meetings. Consequently, the Governing Council should re-affirm that policy decisions will be made on a “data-dependent and meeting-by-meeting” basis, and that no ‘pre-commitment’ is being made to a particular policy path.

Of most interest at the March meeting will likely be whether policymakers elect to maintain the description that policy remains “restrictive”. Some of the ECB’s hawks, including Exec. Board member Schnabel, have been pushing for this label to be dropped in recent remarks though, at this stage, with the deposit rate still above the top-end of neutral estimates, a compromise solution is likely to be a discussion on this topic, while maintaining that description for the time being.

In any case, incoming eurozone economic data supports the case for further steps to remove policy restriction.

On inflation, despite headline HICP having risen for the third straight month in January, to 2.5% YoY, this is unlikely to be of much concern to policymakers, with the bulk of this increase having been driven by higher energy prices, and an unfavourable base effect from 2024. In fact, with core and services prices continuing to slide, the balance of risks continues to tilt in favour of inflation undershooting the 2% target, as opposed to the sustained overshoot that some policymakers appear to be worrying about.

Consequently, the latest round of staff macroeconomic projections will likely once more point to headline inflation falling back to 2% this year, before dipping marginally below that level next year, though uncertainties around said forecasts remain elevated, given the unpredictable global trade, and geopolitical landscapes.

Meanwhile, turning to growth, risks to the eurozone outlook remain firmly tilted to the downside, amid a continued lack of sustained recovery in China, ongoing political instability in both France and Germany, as well as the potential for a tit-for-tat EU-US trade war, as the threat of President Trump imposing tariffs on the bloc continues to loom large.

Furthermore, the eurozone has begun the year displaying incredibly lacklustre economic momentum. With GDP having grown by a meagre 0.1% QoQ in the final three months of last year, and recent PMI surveys also pointing to rather tepid conditions, as the composite output gauge remains just a whisker inside expansionary territory.

Finally, as is typically the case, the post-meeting press conference will likely see President Lagarde ‘stick to the script’ in re-affirming that rates are not on a pre-set course, though participants will also be seeking further colour on the degree of unanimity around the decision to deliver a 25bp cut. Any ‘sources’ reports, typically following a few hours after the presser concludes, will also be watched for additional detail on this front.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.