After an uneventful October meeting, the ECB's Governing Council aren't likely to deliver much excitement this time around, with policymakers set to round out the year by standing pat on all policy instruments.

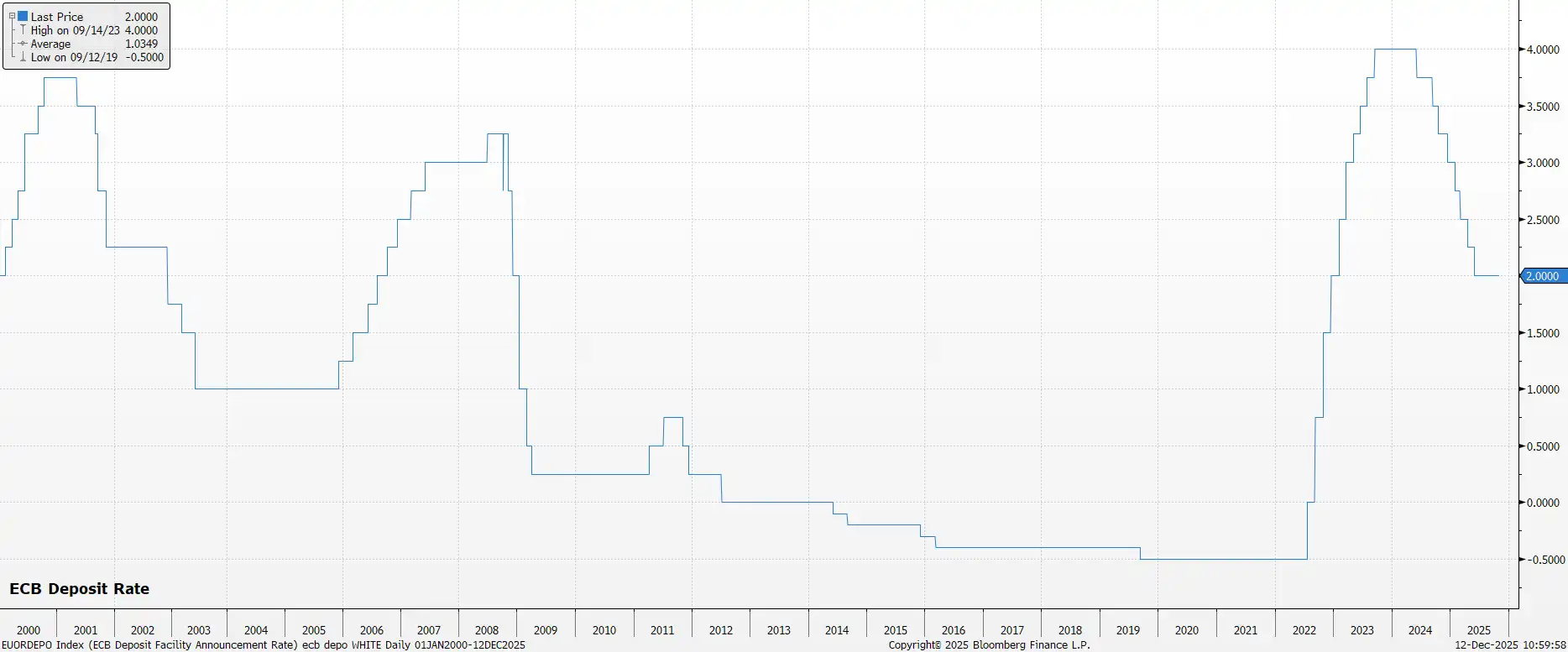

The ECB is set to maintain the deposit rate at 2.00% at the December policy meeting. The EUR OIS curve discounts next-to-no chance of further easing, and GC members have shown little desire to reduce rates further. All signs point to the easing cycle having ended, with 2.00% being this cycle's terminal rate.

That said, the swaps curve now discounts around a 1-in-5 chance of a 25bp hike by end-2026, spurred by hawkish comments from Executive Board member Schnabel. This pricing appears over-ambitious given the likelihood of a sustained inflation undershoot, so participants will watch for any pushback on near-term tightening prospects.

With policy settings unchanged, focus falls on potential guidance tweaks. However, chances range between 'incredibly slim' and 'none at all'. The statement will simply reiterate familiar commentary, repeating that policymakers will adopt a 'data-dependent' and 'meeting-by-meeting' approach with no 'pre-commitment' to a particular path.

The most interesting element will be the updated staff projections, particularly the first look at 2028 forecasts.

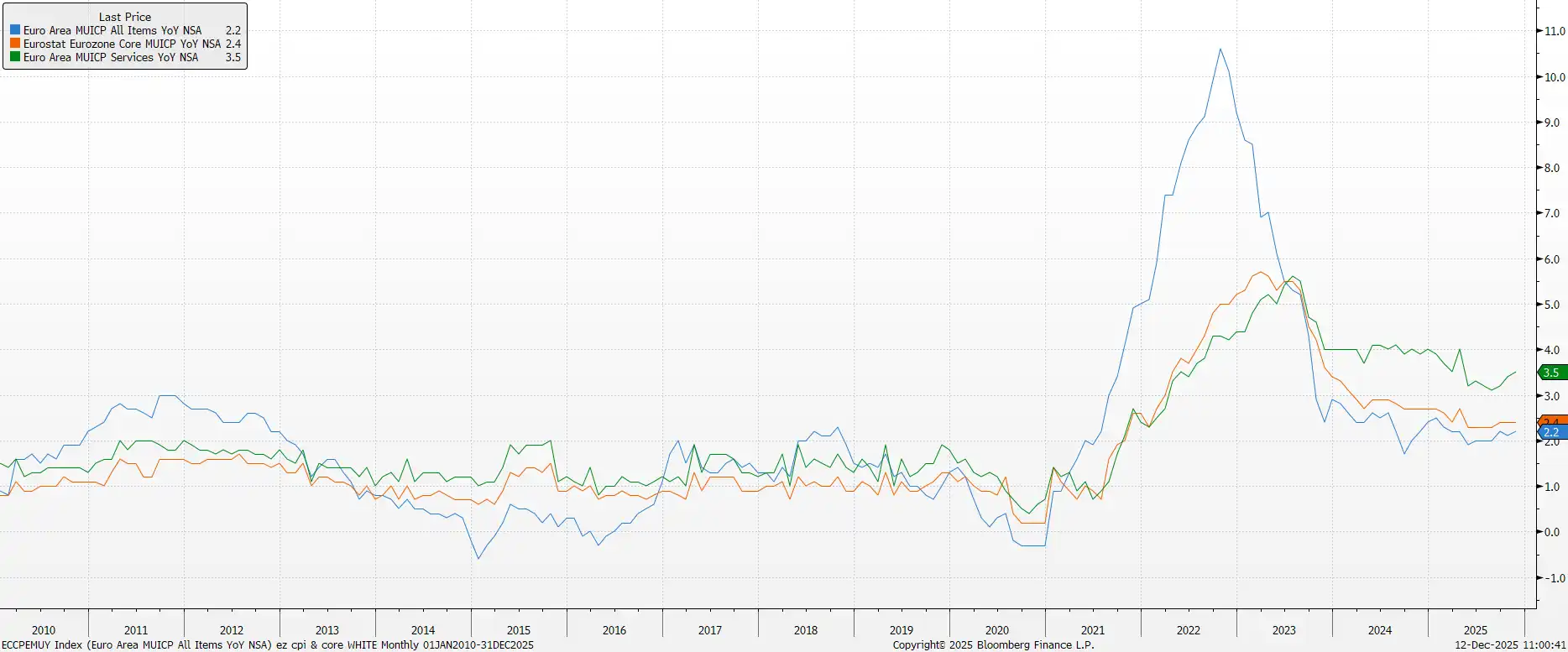

On inflation, projections likely show headline CPI undershooting 2% in both 2026 and 2027. While services inflation has bubbled up recently, early 2026 will see significant energy-induced base effects drag headline metrics lower. Key questions include whether headline inflation returns to 2% by end-2028, and if another undershoot would prompt doves to push for further easing in early 2026.

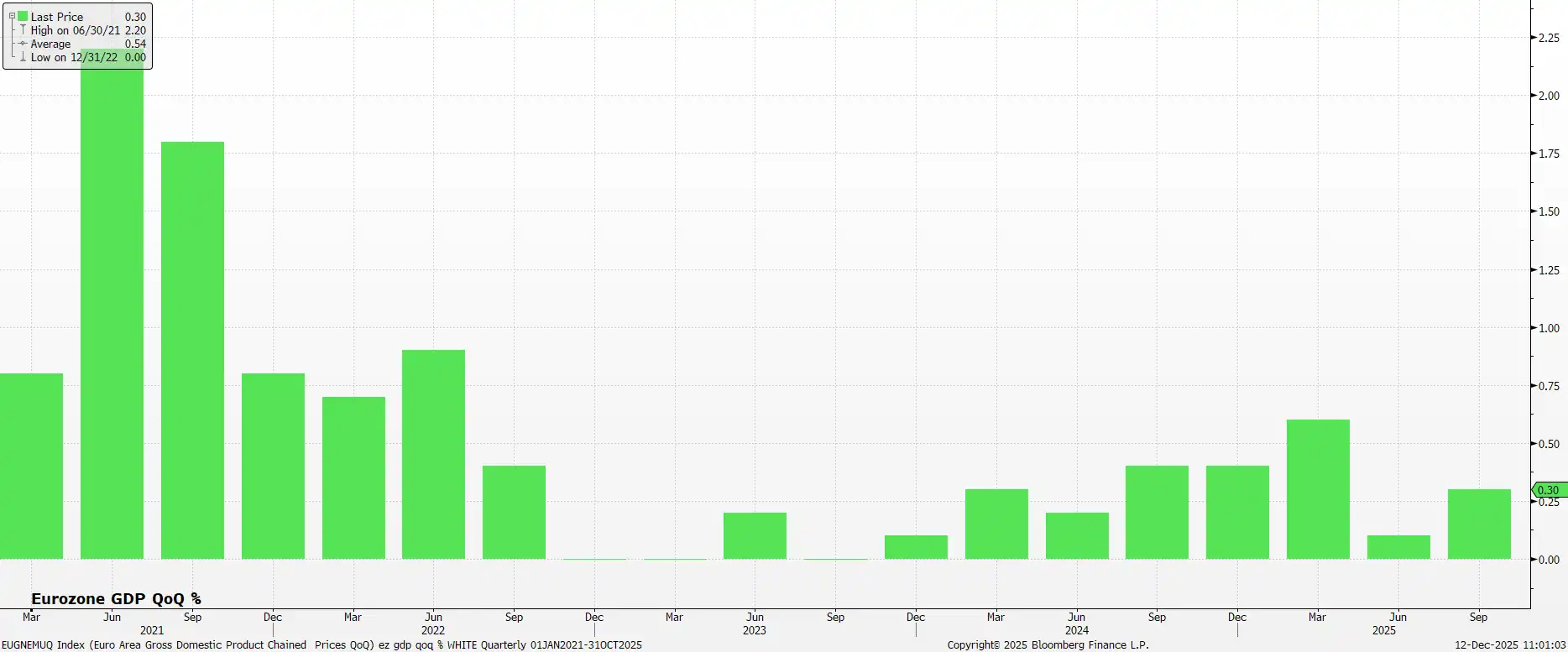

On growth, expect relatively little change to the GDP forecast path. Headwinds buffeting the eurozone in 2025 will increasingly turn to tailwinds next year, including increased trade certainty (especially with the US), lagged effects of ECB easing, and a broadly looser fiscal stance. Germany will drive most fiscal boost through defence/infrastructure spending and tax changes supporting consumption, offsetting consolidation in France and Italy. The eurozone should work back towards potential growth in 2027-2028.

President Lagarde is unlikely to 'rock the boat' at the post-meeting press conference, raising prospects of another dull affair. She'll likely reiterate that policy is in a 'good place' and confirm the December decision was unanimous. Post-meeting 'sources' stories will be watched for insights on how much weight policymakers place on 2028 inflation forecasts.

Overall, the December meeting won't be a game-changer. While doves may argue for another cut early next year, an overwhelming majority likely see little need for more accommodation. Barring material growth deterioration, policymakers will tolerate modest inflation undershoot, prioritising 'hard' data over projections.

The base case remains that the easing cycle has ended, with the next move being a hike—though near-certain not to come in 2026. The deposit rate should remain at 2.00% through end-2026, with tightening eventually addressed in 2027.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.