The dollar softens as poor retail sales and weak labour market signals fuel caution ahead of the January payrolls report. Sterling and the euro hold their ground, while the yen gains strength amid Japan's political shift.

GBP: Political Uncertainty and Rate Cut Bets Linger

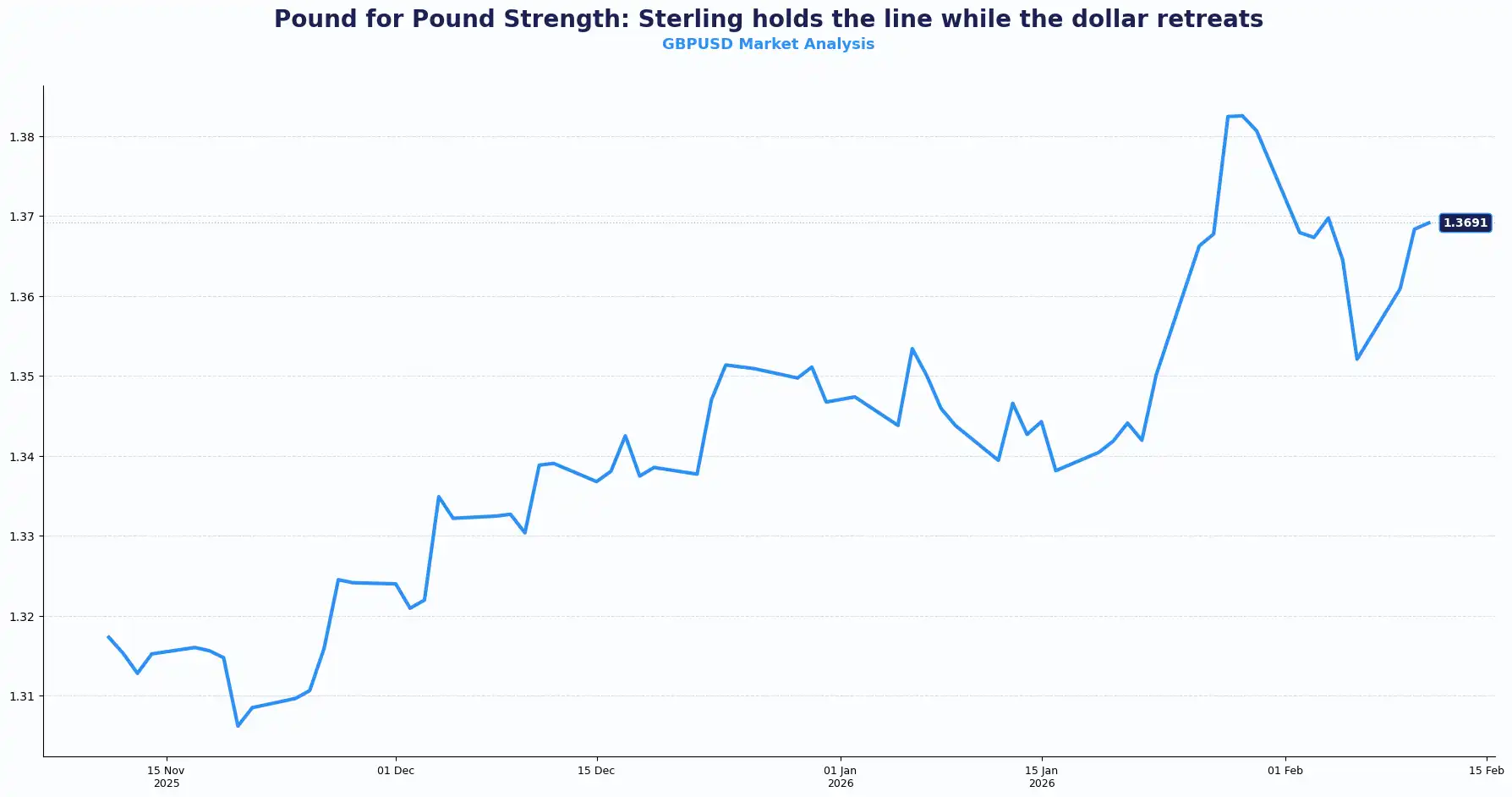

GBP/USD hovers around 1.3690, staging a modest comeback from recent setbacks yet trading below the late January high at 1.3870. Political uncertainty continues to pressure the pound. The Cabinet’s support for the Prime Minister has helped to temporarily stabilise sentiment around sterling and reduced the immediate risk of a sharp sell-off.

Labour sources reported significant resistance within the party to launching a leadership challenge before May's local elections. Questions persist over whether Starmer will be the prime minister through year-end despite his strong 2024 election result. The risk of a leftist turn under an Angela Rayner-led Labour Party presents downside risks to the pound and British assets.

The Bank of England (BoE) held rates at 3.75% in a 5-4 split decision but struck a more dovish tone than anticipated. Policymakers expect that CPI inflation should return towards the 2% target by April, increasing the expectations of BoE rate cuts and weighing on the pound.

Sterling faces a tug-of-war between political friction and softer policy guidance pulling in opposite directions. Current volatility has led some market participants to review sterling exposure before further rate cut expectations take hold.

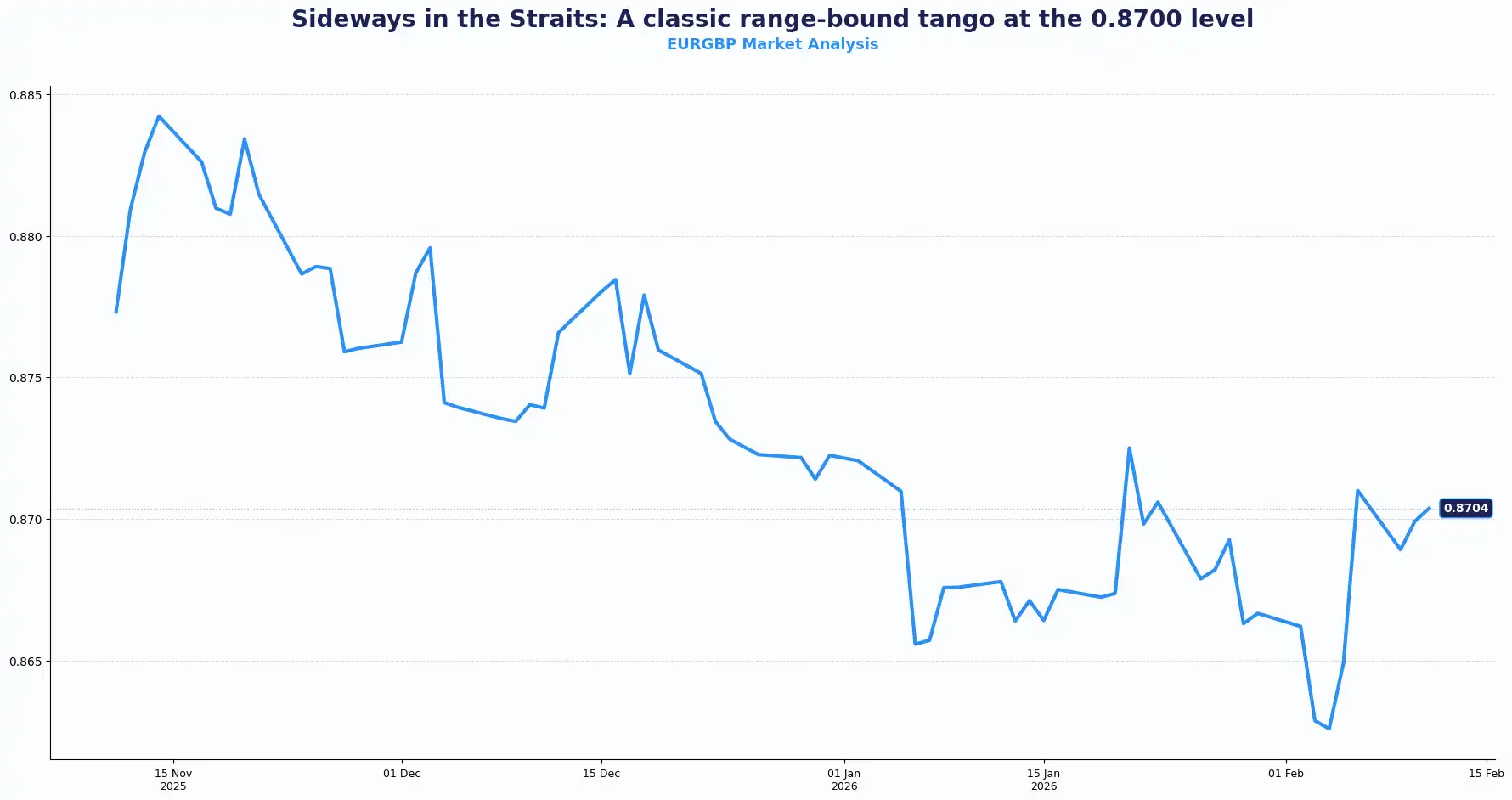

Political headlines and rate pricing continue to drive volatility across the pound complex, reflecting tension in the cross-flows. EUR/GBP holds gains around 0.8700. GBP/JPY fell to a nearly two-month low around the mid-209.00s as yen strength builds.

EUR: ECB Signals Balanced Growth Path

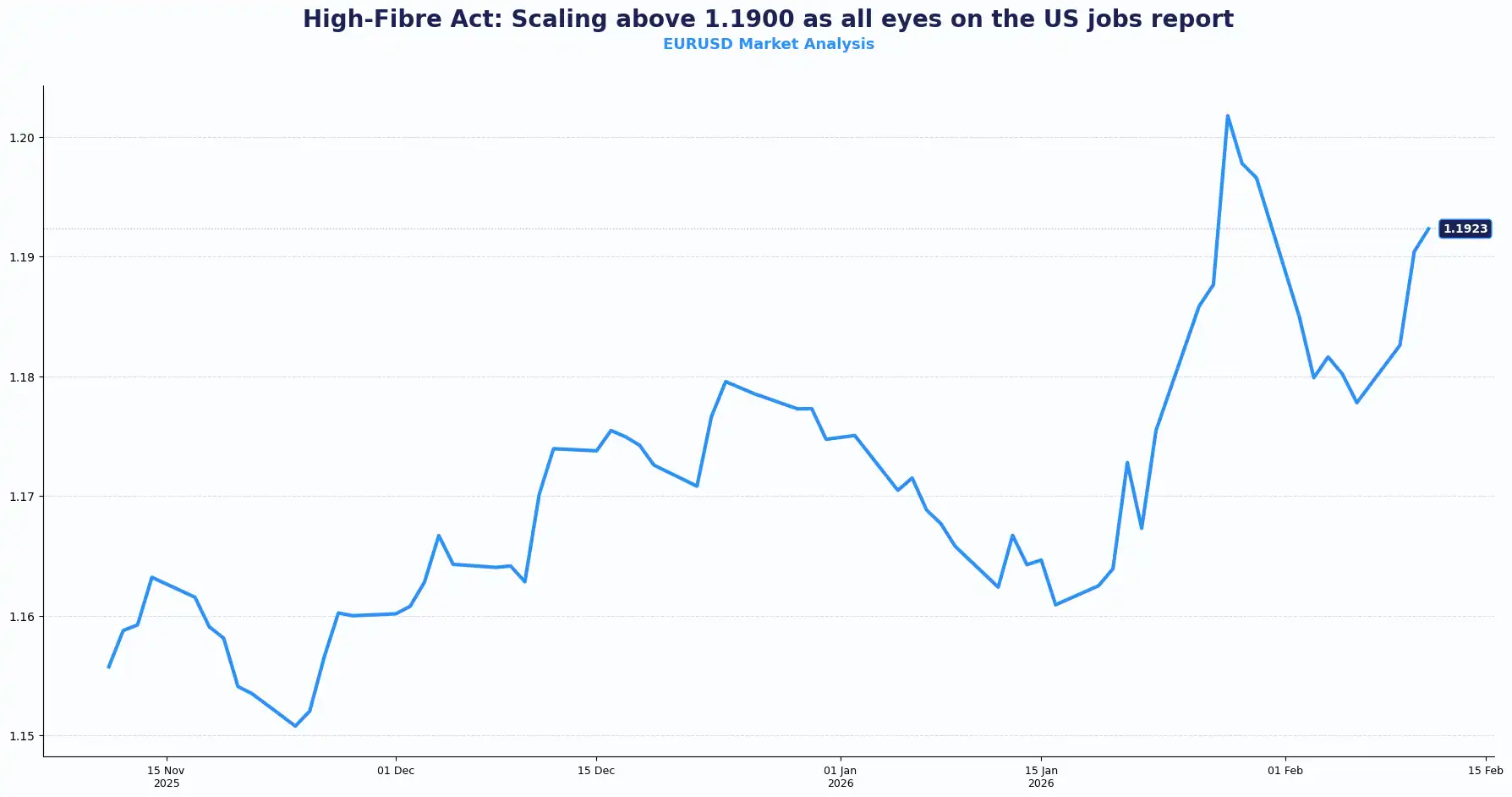

EUR/USD holds above 1.1900, its highest level since late January, as investors position ahead of the US Jobs report later today.

The currency also drew support from signals that the European Central Bank (ECB) is largely unfazed by the euro’s recent appreciation as well as reports that Bank of France Governor François Villeroy de Galhau who is considered a policy dove, will step down in June, more than a year before his term was set to expire in October 2027.

ECB Vice President Luis de Guindos expects Q1 GDP to beat projections, a view supported by leading economic indicators. Trade tensions with the U.S. have eased. De Guindos considers current interest rates as appropriate for prevailing conditions. However, he rejects the characterisation of the economy as being in a "good place”, citing the continued pressure of high consumer prices on households. Additional diversion of Chinese products to the eurozone may exert a downward impact on both inflation and growth.

De Guindos cautioned that calm debt markets cannot be taken for granted. He observed no surprises in the evolution of EUR/USD and does not view the euro's appreciation as dramatic, but noted that the ECB continues to monitor the pair’s trajectory.

The euro avoids dramatic swings despite slow growth. This neutral stance from Frankfurt has led some participants to review euro-denominated exposure.

The ECB signals stability, not urgency. EUR/USD direction hinges on US data rather than Frankfurt. Relative policy pricing against the Fed drives near-term flows

USD: Payrolls Data Clouds Dollar Outlook

The dollar trades on the back foot ahead of US Nonfarm payrolls (NFP). The greenback (DXY) fell 0.33% to 96.60. Soft retail sales and slowing labour costs weighed on the greenback.

Last week's ADP print showed just 22,000 private jobs added in January, well below expectations, denting confidence in US labour momentum.

White House economic adviser Kevin Hassett said Americans could see smaller job growth numbers in coming months due to lower population figures and higher productivity.

January non-farm payrolls are expected to rise at 70K. The unemployment rate is seen at 4.4%. Annual wage inflation, measured by average hourly earnings are forecast at 3.6% YoY, down from 3.8%. The low-fire, low-hire labour market continues. Below-consensus payrolls would likely weigh further on the dollar.

Wage inflation is a key focus, with average hourly earnings tracking below estimates likely to cap dollar gains, even if headline NFP aligns with consensus. Subdued wage growth would weigh on consumer spending and reinforce the case for a dovish tilt from the Federal Reserve (Fed).

A sub-30K NFP print alongside a surprise uptick in unemployment would likely weigh on the dollar, paving the way for further EUR/USD gains. Conversely, an NFP outcome at or above forecast would support expectations for a Fed hold, with positioning indicating scope for additional dollar upside.

Friday brings the delayed US CPI inflation report, another key piece in the dollar puzzle. Inflation data helps participants anticipate when the Fed might adjust rates, which directly impacts currency valuations. Volatility often leads market participants to evaluate hedging options as the Fed outlook shifts.

U.S. payrolls and wage data stay key drivers for Fed rate expectations, with the dollar largely tracking shifts in pricing rather than headline risk. Cross-currency volatility could be expected around the data release.

YEN: Election Win Fuels Fiscal Discipline Bets

Asian trading volumes were subdued with Japan closed for a holiday, while the yen advanced 0.4% to 153.80 per dollar, extending gains after weekend election results. Prime Minister Sanae Takaichi’s decisive win consolidates her control over fiscal policy, fueling expectations of tighter discipline and potential market-friendly reforms. Anticipation of further Bank of Japan rate hikes continues to support the yen, with intervention concerns lingering.

AUD: Breaks Three-Year High on Hawkish RBAs

AUD/USD climbed above $0.71 for the first time since 2021, last up 0.53% at $0.7112. The pair is forecast to finish the year at $0.73. RBA Deputy Governor Andrew Hauser said inflation was too high and reiterated policymakers' resolve to restore price stability. Last week's 25bp hike to 3.85% marked the first G10 move outside Japan this year. Markets price a 70% probability of a further increase to 4.10% at the May meeting, pending Q1 inflation data.

Markets look ahead:

Friday, 13 Feb: US CPI

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.