Euro Steadies as ECB Calm Contrasts US Policy Drama

Dollar Retreats as Politics Overshadow Solid US Data

The US dollar started the week on the back foot, with the Dollar Index easing toward 99.00 after pulling back from recent multi-week highs. Early gains linked to trade headlines faded as markets reassessed the implications of US President Donald Trump’s latest tariff threats targeting Europe.

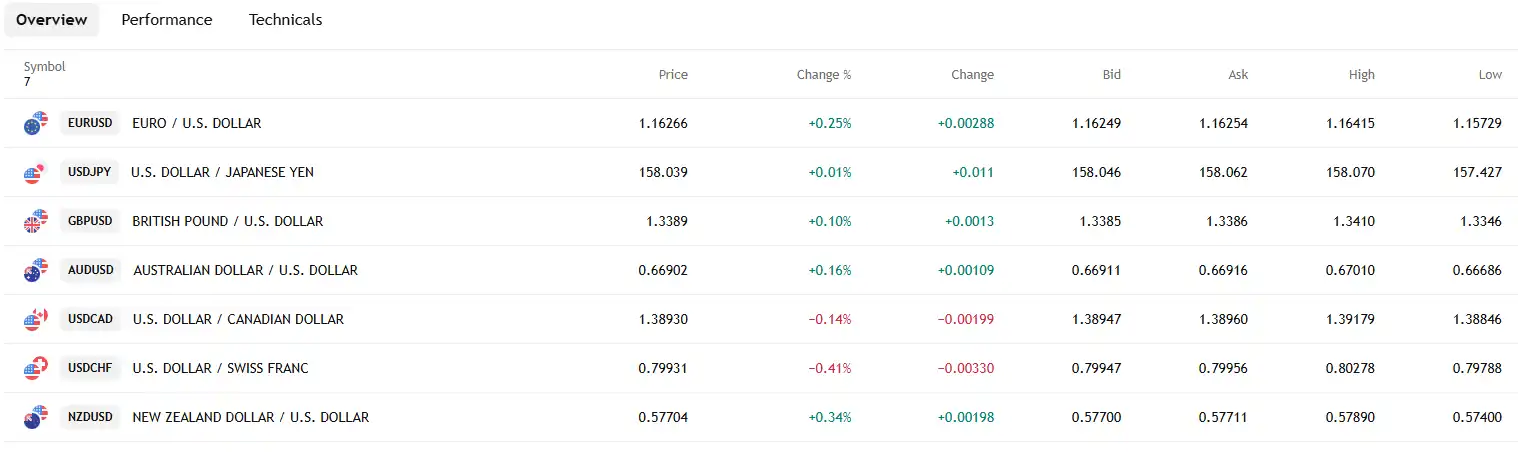

Last week, President Trump announced plans to impose an additional 10% import tariff on goods from eight European countries, effective February 1, unless the US is permitted to purchase Greenland. The announcement prompted a swift risk-off move in early Asian trade, with the euro and sterling selling sharply. EUR/USD briefly touched a seven-week low near 1.1570, while GBP/USD fell to a one-month low around 1.3340. However, the initial reaction quickly reversed.

With the start of European trading, the dollar faced renewed selling. Market participants weighed the risk that further trade escalation with key allies could have a greater negative impact on the US economy, given Europe’s significant holdings of US assets. European investors are estimated to hold around $8 trillion in US stocks and bonds, underscoring the potential risks posed by prolonged tensions.

By mid-session, the euro recovered approximately 0.3% to trade near 1.1630, while sterling rebounded toward 1.3401. The dollar also softened against traditional safe-haven currencies, with USD/JPY falling to around 157.80 as risk aversion picked up. Cryptocurrencies also came under pressure, reflecting a more cautious market tone.

European officials responded promptly, with France labelling the Greenland-related tariff threat as economic blackmail. Discussions began on reinstating retaliatory tariffs on US goods and potentially activating the EU’s anti-coercion instrument. Emergency meetings are scheduled in the coming days, keeping trade tensions in focus.

Beyond geopolitics, domestic US factors added another layer of complexity. While recent labour data has been firm, pushing expectations for further Federal Reserve (Fed) rate cuts back toward June, the Department of Justice’s (DoJ) decision to launch a criminal probe into Fed Chair Jerome Powell has unsettled markets. What was once a policy disagreement has evolved into a political drama, raising concerns about central bank independence.

These concerns were evident in other markets as well. Gold climbed to a new record above $4,600 as traders sought safety. Futures pricing now indicates a roughly 95% probability that the Fed will keep rates unchanged at its January 27-28 meeting. The dollar’s decline reflects growing unease that political pressure could prompt the Fed to adopt a more accommodative stance, a scenario that typically weighs on the currency.

US markets remain closed on Monday, as the US observes Martin Luther King Jr. Day, which is likely to amplify price moves amid reduced liquidity. In the near term, the dollar’s direction will depend less on incoming data and more on whether trade threats materialise and if confidence in US policy credibility is maintained.

[Source: Tradingview.com]

[Source: Tradingview.com]

Euro Steadies as ECB Calm Offsets Trade War Concerns

The euro recovered early losses and stabilised as market investors shifted attention from renewed trade tensions to the European Central Bank’s (ECB) consistent policy stance and inflation returning to target.

Eurozone inflation eased to 2.0% in December, meeting the ECB’s target and reinforcing expectations that rates will remain unchanged. Policymakers emphasise a data-driven approach without pre-committing to a policy path. ECB officials have dismissed speculation about further rate hikes, with ECB member François Villeroy de Galhau recently calling talk of a 2026 hike “fanciful,” highlighting the central bank’s confidence in current settings.

Eurozone data remain mixed. Germany is expected to post 0.2% growth in 2025 after two years of contraction, supported by household and government spending. However, manufacturing softness continues to cap any shift in policy expectations.

This week, attention is on the Eurozone December CPI and ECB Board member Piero Cipollone’s appearance at the Eurogroup meeting. Consumer expectations data show a slight improvement in the 12-month-ahead unemployment rate to 10.9%, indicating cautious optimism among households.

The euro’s resilience is also supported by market investors' positioning, as European investors remain overweight on US assets. Ongoing dollar volatility due to political risk has prompted diversification, which limits downside for the euro despite ongoing tariff concerns. For now, euro price action is driven more by dollar uncertainty than by domestic fundamentals. With steady ECB policy and stable inflation, the euro is likely to serve as a stabilising force in the current environment.

Market focus ahead

With US inflation pressures easing for now and the ECB maintaining a steady policy stance, near-term FX moves are likely to be shaped more by political developments than by economic data. Trade headlines, central bank autonomy, and shifts in risk appetite are expected to drive direction, with the dollar likely to remain under pressure.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.