January Review & February Risk Events & Themes

Pound Sterling

The UK economy hit some expected beats and tossed up a few surprises for traders to ponder throughout the month of January.

On the expected front, year-on-year inflation came in at 10.5% in December as announced on January 18, hitting forecasts on the nose. It marked the second consecutive month of slowing inflation and the lowest rate in three months, after a peak of 11.1% in October, mainly due to the steep fall in petrol prices.

Unemployment stayed at 3.7%, matching expectations too.

As for surprises, not all of them were pleasant. House prices came in far lower than expected. Halifax data published on January 6 showed a year-on-year increase of just 2%, slowing from a 4.6% gain in the previous month marking the poorest rate of growth since October 2019.

At the same time, homeowners are contending with overweight mortgage rates. Explaining why, Robert Gardner, Nationwide's Chief Economist, said: “While financial market conditions have settled, mortgage rates are taking longer to normalise and activity in the housing market has shown few signs of recovery.

“It will be hard for the market to regain much momentum in the near term as economic headwinds strengthen, with real earnings set to fall further and the labour market widely projected to weaken as the economy shrinks."

The British economy on the whole expanded 0.2% year on year according to the January 13 statement, slightly below expectations of 0.3%.

Given the mixed messaging on the state of the UK economy, the markets and policymakers alike remain conflicted.

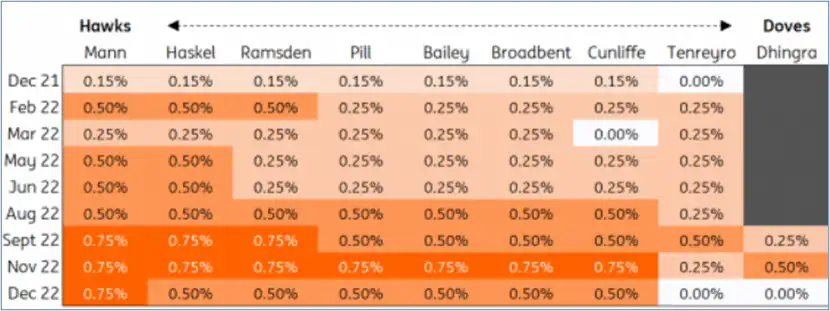

Rifts among central bank policymakers can be as powerful a market catalyst as the outcome of their actual policy decision, as well as fermenting uncertainty among traders. Thankfully, the BoE generally moves as a pack, although as you can see below, September 2022’s policy decision was particularly narrow, and the doves still command a voice on the board, more so since the addition of Dr Swati Dhingra in September.

Perhaps that explains why, according to analysts at ING, “a 50 bps hike is not fully priced in” for the bank’s interest rate decision scheduled for this coming Thursday, thus Sterling could potentially enjoy some limited and temporary strength should the BoE indeed hike 50 bps.

How Bank of England policymakers vote – Source: Bank of England/ING

How Bank of England policymakers vote – Source: Bank of England/ING

“The markets are about 65% confident of a 50 bps hike owing to high underlying inflation, strong wage growth and unexpected resilience in the economy,” said market analyst Fawad Razaqzada at StoneX Group.

Looking across the monthly trading session, GBP/USD closed 1.09% higher at 1.23. As for EUR/GBP, the pair ended slightly less than a percentage point lower at 87.67p.

EURO

The common currency was the strongest among its peers throughout January, encouraged by an ongoing dogged determination from the euro hawks to keep as tight a stranglehold on interest rates as they can get away with, thus limiting the supply of market liquidity.

As announced on January 27, Loans to households and companies in the euro area grew at a slower rate in December 2022, with household loan growth at 3.8% year on year, the weakest since May 2021 due to rising borrowing costs and high inflation. The overall private sector credit growth, including households and corporations, slowed to 4.2% from 5.1%.

Year-on-year inflation as read on January 6 actually came in far softer than expected, at 9.2% against a consensus forecast of 9.7%, down from November's 10.1% and October's all-time high of 10.6%.

Perhaps in another context, it would be a cause for celebration, but the fact of the matter remains that inflation is still 7.2 percentage points below what the ECB deems acceptable.

Yes, it was a particularly warm winter, but a sharp fall in energy inflation was offset by faster increases in the price of services, non-energy industrial goods, food, alcohol, and tobacco. Hence why the core inflation rate – which strips out volatile food and energy prices – actually came 0.2 percentage points higher than anticipated at 5.2%

Additionally, the unemployment rate across the euro area remained at an all-time low of 6.5%, with Germany, and the Netherlands posting the lowest figures, and Spain, Italy and France the highest.

With the above in mind, another 50 bps rate hike is more than likely when the ECB meets on February 2. Greater anticipation surrounds what policies the bank might hint at for the months ahead though it’s looking likely that the terminal rate will cap at 4%.

Amid these inflationary pressures and hawkish forecasts, EUR/USD hit nine-month highs of 1.086 on January 23. For the whole of the month, the pair rose around 1.5%.

EUR/GBP went through a series of mood swings this month – Source capital.com

EUR/GBP went through a series of mood swings this month – Source capital.com

EUR/GBP had a more convoluted journey, as you can see from the above chart. The pair initially dipped in the first weekly session, largely due to the eurozone’s surprisingly soft inflation read on the sixth on the month. But traders quickly regained their wits and drove the pair to an intra-month high of 88.94p by January 12, only to encounter a 2% of downside for an intra-month low of 87.21p seven days later.

The EUR/GBP pair encountered another bull-to-bear cycle before ultimately closing the month slightly less than a percentage point lower at 87.82p.

US Dollar

One of the more interesting movements on the US dollar occurred when northern neighbour Canada declared a pause in bank rate hikes after a 25 bps hike on the 25th of the month. Simultaneously, the Bank of Canada (BoC) announced the continuation of its quantitative tightening programme to complement an aggressive monetary policy that saw rates rise to 4.5% over the past year.

The loonie’s negative reaction to the news spilled over into the greenback, with GBP/USD rallying 80 pips to 1.241 by the end of the session and EUR/USD adding a lighted 30 pips to 1.092.

Some analysts surmised that the markets were quick to price in a higher risk of the Federal Reserve following the Bank of Canada (BoC)’s dovish strategy with a softer rate rise in February. It is worth acknowledging though, that the greenback was already losing momentum well before the BoC’s announcement.

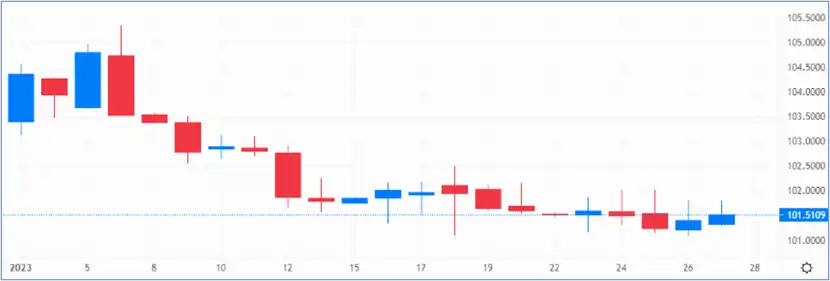

Although the first week of the year saw the US Dollar Index (DXY) around 2% higher, mainly to due unexpectedly strong employment data, the index ended the month nearly 4% lower at 101.69 from the January 6 peak of 105.35.

Looking at the longer time frame, DXY now sits 14% lower than the 2022 highs achieved in September.

The US Dollar Index (DXY) closes the monthly session lower – Source: capital.com

The US Dollar Index (DXY) closes the monthly session lower – Source: capital.com

The dollar’s weakness was most pronounced against the euro. Although EUR/USD got off to a sluggish start (due to the aforementioned employment read), the pair quickly changed direction to end the month 1.5% higher at 1.086.

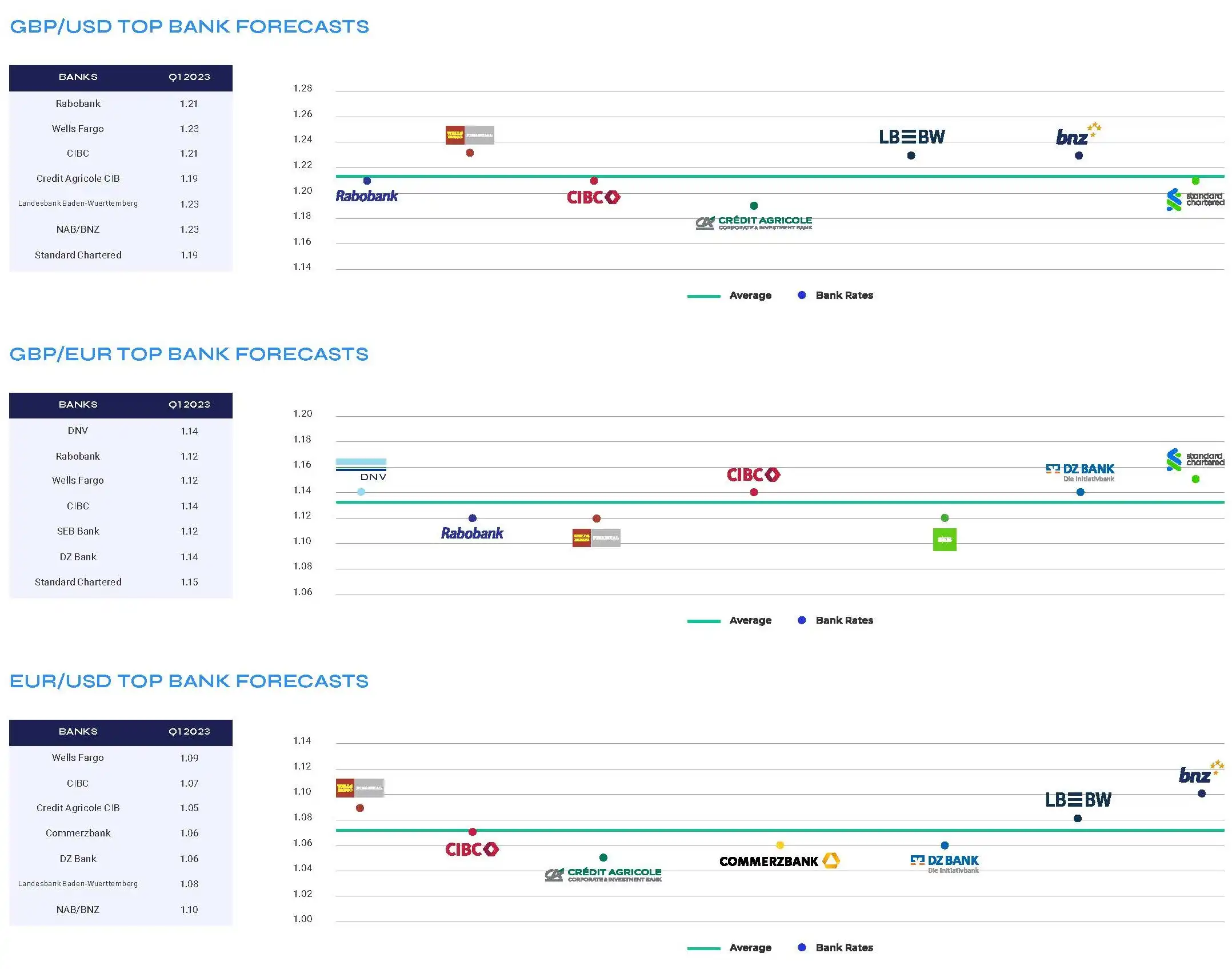

TOP BANK FORECASTS

Download report here

JANUARY RISK EVENTS AND KEY THEMES

UNITED KINGDOM

Tax Cuts?

Jeremy Hunt, UK chancellor of the exchequer, stated at a Bloomberg event in London on Friday, January 27 that the UK does not have the headroom for tax cuts and “sound money must come first”. Yet despite Hunt being fairly clear that the March budget will not include cuts, as well as the spectre of the Kwarteng-Truss mini-budget casting a shadow over the conversation, some annals of the Tory party remain vocal on the benefits of tax cuts under to guise of a ‘pro-growth’ agenda.

One of them, the former cabinet minister David Jones, recently told the Daily Mail: “I don’t know how the country is going to manage that level of indebtedness if the country is not growing. The Chancellor has got to put pro-growth provisions into his Budget. Simply putting in high taxes that will stifle growth is not what we need.” So with divisions mounting, tax cuts could become a hot topic of debate going forward.

Gas Prices:

“Falling gas prices do not just lower inflation and boost growth prospects. Where governments capped households’ and firms’ energy prices, spending will be much lower than assumed, 0.3-0.9% of GDP per year according to our estimates,” said analysts at Citi, continuing: “Other support measures such as indirect tax cuts or tax credits could be phased out earlier, creating even more fiscal space. Lower public borrowing needs could create space for an accelerated central bank balance sheet unwinding as well.”

Wage Inflation:

Wage growth is persistently high in the UK, growing 6.4% year on year in the three months to November 2022 per the latest data read. Even though that’s well below the rate of inflation, making earnings in real terms a few percent lower year on year, the BoE will be more than happy to bandy the stats about, in conjunction with historically low unemployment figures to justify its hawkish stance of monetary policy.

However, there are a few things to keep a close eye on, i.e. the fall in the number of vacancies in the job market and the increase in redundancies and people claiming unemployment. A substantial spike in these metrics would suggest that the jobs market isn’t completely infallible right now.

EURO ZONE

Private Lending:

There is evidence of a decline in bank lending in both household and non-financial corporate sectors in December. Household borrowing growth slowed down to 0.1% from 0.3% in November, while non-financial corporate sector borrowing growth turned negative, falling from -0.1% in November to -0.3% in December.

These sharp declines in business borrowing growth are what the ECB wanted in order to cool the economy down, but they are considered a sign of a recession.

French Retirement Age:

Emmanuel Macron wants to raise the retirement age from 62 to 64. Unsurprisingly, French citizens aren’t so happy about this, with protests against pension reformers growing. In Macron’s defence, France has one of the lowest retirement ages in the industrialised world, and also spends more than most other countries on pensions at nearly 14% of economic output, according to the Organisation for Economic Cooperation and Development. In the protestors’ defence, who wants to retire later than they have to? Expect tensions to grow.

USA

Quantitative Tightening:

Federal Reserve governor Christopher Waller said earlier in the month that the bank could start slowing its balance sheet roll off “as we approach maybe reserves being 10% to 11% of GDP… and then we'll kind of feel our way around to see where we should stop”. The bank has already scaled back around US$400bn, or just shy of 5%, of treasuries and mortgage-back securities in the past 12 months in order to help in the fight against inflation.

On the other hand, the bank could theoretically ramp up its open market operations (OMO) in the short term, thus increasing the supply of government bond liquidity, as a trade off for lowering the benchmark rate. Therefore, it will be worth keeping a check on the Fed’s balance sheet in order to gauge the pace of QT. That's what the Bank of Canada did after all.

Consumer Spending:

US consumer spending slowed down in the fourth quarter of 2022 with month-on-month real spending growth of 0.4% in October followed by -0.2% in November and -0.3% in December, per the January 26 report. This trend is laying the ground for a contraction in the first quarter of 2023 if growth doesn't improve. ING analysts are “not confident” about a month-on-month turnaround in order to get back to an upward trend.

Inflation:

As sick as everyone is of talking about it, inflation remains a defining factor of US monetary policy. Inflation pressures have certainly been easing, with the core personal consumer expenditure index falling to a one-year low of 4.4% in December of 2022 from 4.7% in the prior month.

The February read will therefore be hotly anticipated since a continual downward trend will be a boon to those hoping for lower interest rate hikes moving forward. But the Fed does remain wary, so a hawkish surprise shouldn’t be taken off the table altogether.

KEY DATES IN FEBRUARY

United Kingdom

- February 1: Manufacturing PMI (46.7 exp); Nationwide housing prices YoY

- February 2: Interest rate decision (4% exp)

- February 3: UK services PMI (48 exp)

- February 6: New car sales; Construction PMI

- February 7: Halifax house price index; BBA mortgage rate (6.6% exp)

- February 10: GDP growth rate YoY (0.1% exp)

- February 14: Unemployment rate (3.8% exp)

- February 15: Inflation rate YoY (10.3% exp)

- February 17: Retail sales YoY

- February 24: Car production YoY

EUROZONE

- February 1: Manufacturing PMI (48.8 exp); Unemployment rate (6.5% exp); Inflation rate YoY (-0.2% exp)

- February 2: Interest rate decision (3% exp)

- February 3: Services PMI (50.7 exp)

- February 6: Construction PMI (43.1 exp); Retail sales YoY (-1.8% exp)

- February 14: GDP growth rate YoY

- February 15: Balance of trade; Industrial production (1.5% exp)

- February 20: Construction output (2.1% exp)

- February 23: Inflation rate YoY

UNITED STATES

- February 1: Interest rate decision (4.5% exp); Thirty-year mortgage rate

- February 2: Jobless claims

- February 3: Unemployment rate (3.6% exp); non-farm payroll (155,000 increase exp)

- February 7: Balance of trade (-$68.8bn exp)

- February 10: Michigan consumer sentiment

- February 13: Consumer inflation expectations

- February 14: Inflation rate (6.3% exp); consumer price index

- February 15: Retail sales Yoy (4.5% EXP)

- February 16: PPI YoY (6% exp)

- February 17: Import/export prices

- February 22: FOMC minutes

- February 23: GDP growth rate QoQ (2.8% exp)

- February 28: Redbook YoY; House price index YoY

Download report here

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.

Download full report here

Important Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not take into account the investment objectives, financial situation, or specific needs of any individual readers. We do not endorse or recommend any specific financial strategies, products, or services mentioned in this content. All information is provided “as is” without any representations or warranties, express or implied, regarding its accuracy, completeness, or timeliness.